In this post Anders Liu-Lindberg a leading advisor to senior FP&A professionals reveals the 10 biggest trends impact FP&A in 2022. Prefer a video version? Watch it below.

10: FP&As will drive a strategy revolution

2022 will be the year that FP&A realizes its mission of driving the right strategic choices. In particular, FP&A will take advantage of its strategic advantage.

You know when you stop thinking about debits and credits and being chained to your desk without talking to anyone.

This strategic revolution means joining meetings, understanding the business, making a noise and chasing the strategic value for your business.

This strategic advantage for FP&As will rock the CFO’s office and lies in the fact that FP&As:

- Know how to make money

- Use analytical capabilities

- Take a cross-value chain perspective

- Leverage our access to finance and non-finance data

- Use our seat at the decision-making table proactively

In 2022 us FP&As will help our companies be successful rather than simply reporting on their merits. 2022 will be the year where we unlock this strategic mindset.

9. The Great Resignation 2.0

In 2022 FP&A professionals continue to jump ship to companies that take an innovative approach to financial planning and analysis and not for companies which wear down its people through endless reporting and planning cycles. The FP&A Reddit boards will continue to light up with posts such as this.

Businesses don’t function without people. In the past, this would have seemed so obvious that it might be considered pointless to say. But That is no longer the case. In 2022, with digital transformation at full pelt and automation changing the nature of work, many business leaders seem to have forgotten that people are the only asset that truly matters. I firmly believe that the Finance Function should be in the driving seat of business development and at the heart of modern business.

8. The Big Switch: CFOs invest Big in FP&A

2022 will finally be the year that CFOs are investing more in FP&A professionals compared to say, sales people. This ranges from incentives for FP&A professionals to sharing tech wealth with the Cinderella service of FP&A.

To stress the tech gulf in FP&A teams, 47% of those in consolidated annual planning and budgeting use digital technologies.] This compares poorly with other departments where 82% of top salespeople cited digital tech as critical to the ability to be high performing, or 75% of marketing employees use automation tools. That hurts, but it will get better in 2022 with some amazing tools for FP&A on the market.

7. Predictive Analytics Becomes your New BFF

Predictive analytics is going to be a major force in 2022. This partly as a response to the COVID challenge. Predictive analytics is a branch of advanced analytics that makes predictions about future outcomes using historical data combined with statistical modeling, data mining techniques, and machine learning. Predictive analytics can be used to get clarity on what the future can look like. In one instance, a pharmaceutical company has relied on predictive analytics to forecast its sales and revenue using what is referred to as a “competition” of more than 50 algorithms, or models based on data from the past 24 months. A model includes sets of potentially causal KPIs including research and development expense per drug developed, number of new drugs in the development stage.

6. Excel to evolve with Tech Superpowers

Excel will turn 37 in in 2022.

Now every year for the last decade people in FP&A have been calling for the end of Excel. It doesn’t end well.

Whatever happens in 2022 it will continue to be loved by FP&As and used widely.

It is cheap, easy to use, and flexible. But if you are using Excel as it is, things need to change.

Companies like Datarails have turned Excel into a lean mean FP&A machine avoiding long implementation and allowing you to keep your models. But without such add-ons, this should be the year that FP&As leave Excel behind as a not fit for purpose FP&A tool, or find ways of automating processes using Excel through fast effective platforms. Automation plus consolidation is absolutely vital.

5. Less planning, more real-time tracking

2022 will mark if not the death of planning, the reducing of its hold in our lives. FP&As will minimize budgeting, and other outdated techniques with more real-time tracking.

Real-time reporting is now table stakes in the rest of business and FP&A must follow. The first analysis of America’s $600 weekly boost to unemployment insurance was published in weeks. The British government knew almost immediately that a scheme to subsidize restaurant attendance had probably boosted COVID-19 infections. Overall, as the pandemic’s impact differed by geographies and markets, FP&A teams must provide more insights and data at increasingly local levels-for example by country, state or even city locations often unable to realize without such data.

For instance, HP was able to impact its models as for instance the Japanese government set up a tender to supply every high schooler with a laptop during COVID-19. Or the amount of laptops moving from one per household to increasingly one per person. Brute force using spreadsheets can take an inordinate amount of time and prevents swift production and real-time analysis.

4. Soft Skills Revolution in FP&A

Most of us grew up thinking that hard skills can be trained and are specific to a job. Soft skills (being the opposite) can’t be trained and are not job specific. I’d argue that both of these statements are wrong and the mere definition of hard and soft skills is the problem. Instead, I would argue for a new definition being: tangible and intangible skills where both can be trained and quantified yet one relates to some physical production be it all skills needed to produce actual products or an analysis of a situation or business issue. The other relates to relationships and what happens between people.

We’ve all been there. Your hard analytical skills produce a second-to-none analysis. However, you fail to present it well and fail to align with key stakeholders on the main conclusions and your analysis gets you and the company nowhere. Without intangible skills, even the best products could be worthless.

This is the year of intangible or soft skills due to a recognition that these skills are what will make us successful.

3. Cool visualizations to wow non-finance professionals

Cool visualizations capture our imagination, and 2021 saw some great data to wow non-finance professionals.

FP&A need to be thinking in terms of catching non-finance professionals with data that tells a story about growth and the future. This can be achieved by integrating your financial model into a visualization tool that even allows you to do simple modeling on the go.

There are clear advantages of integrating your financial model in a visualization tool (i.e financial dashboarding):

- Being visualized in front of your business stakeholders makes it easy for them to understand the effect of various changes

- It reduces the risk of errors as there no transfer happening between different systems or media.

- Significant flexibility is gained as you will never have to take a pause from the meeting to go and simulate the effect of questions asked by business leaders.

- You can even do drill-downs and change the perspective of the discussion by going from high-level to details and back again without getting lost in the numbers .

Many planning tools and visualization tools offer these options today, however, few make it very easy to simulate changes on the go. And this point cannot be underestimated because you want to keep the flow in any meeting.

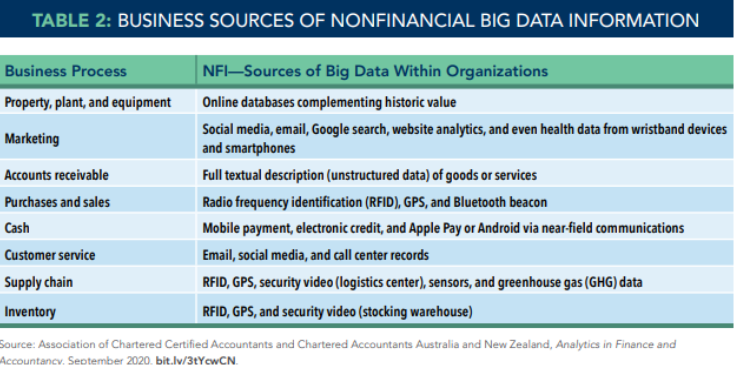

2. The Embrace of non-financial data

Beyond the financial ledgers, FP&A teams now have access to ever growing operational data sources. This data includes customers, demand, and supply chain. It also includes data outside the corporate transaction systems. Things like weather data, social sentiment data, and econometric data. This is going to be leveraged in 2022 by savvy FP&A teams consolidating this date to make decisions.

A balance of financial and non-financial reporting provides shareholders and other stakeholders with a meaningful, comprehensive view of the position and performance of companies that financial information alone cannot provide. This is going to be a game changer.

1. FP&A Moves from Cost Center to Profit Driver

Do we need more and better tools in Finance? Absolutely! Are they a necessity for us to be good business partners? Not at all!

Throughout my career it has never been about the tools but about the mindset. Business partnering is a different way of working that starts with a mindset change. We call it “from cost center to profit driver.

We can only succeed by helping others succeed. The business is not there for the sake of Finance. Finance is there for the sake of the business. Of course, we need to ensure that all rules are upheld and that we are compliant with financial standards. When that is said and done though our only goal is to help business leaders meet or beat their targets. Simply improving a finance process or creating a new report will never be enough.

I hope you have enjoyed this walk through the trends you need to know in 2022 and stay tuned for more insights throughout 2022.