Cost-volume-profit analysis or CVP analysis, also known as break-even analysis, is a financial planning tool leaders use to create effective short-term business strategies.

It conveys to business decision-makers the effects of changes in selling price, costs, and volume on profits (in the short term).

Financial planning and analysis (FP&A) leaders commonly apply CVP to break-even analysis.

Simply put, break-even analysis calculates how many sales it takes to pay for the cost of doing business to reach a break-even point (neither making nor losing money).

Let’s take a sub-tastic example of cost-volume-profit analysis in action:

Imagine you are opening a restaurant selling sub sandwiches. Through your research, you discover you can sell each sandwich for $5. But…you then need to know the variable cost.

Finding the Variable Costs

The variable cost is the cost of making the sandwich (the bread, mustard, and pickles).

This cost is known as variable because it “varies” with the number of sandwiches you make. In our case, the cost of making each sandwich (each sandwich is considered a “unit”) is $3.

Now, what is the contribution margin?

Contribution margin is the amount by which revenue exceeds the variable costs of producing that revenue.

The formula for the calculation of the contribution margin is:

CM = Sales – Variable Costs

Subtract the variable cost from the sale price ($5-the $3 in our sub example).

This gives us the contribution margin. Therefore, in the case of our sandwich business, the contribution margin is $2 per unit/sandwich.

Fixed Costs

Now, we need to know fixed costs. These costs remain constant (in total) over some relevant output range.

Fixed costs include things like rent and insurance.

Whether the sandwich shop sells 50 subs or 50,000 subs, these costs stay the same. In our sandwich business example, let’s say our fixed costs are $20,000.

The Meat of the Matter: Finding the Break-Even Point in Units (or Sandwiches)

To find out the number of units that need to be sold to break even, the fixed cost is divided by the contribution margin per unit.

Break-Even Units = Fixed Costs/Contribution Margin Per Unit

So, $20,000 fixed costs divided by our contribution margin (2000/$2) means we need to sell 10,000 sandwiches If we do not want to lose money.

Setting a Dollar Target For Breaking Even

However, we will likely need to enter a sales dollar figure (rather than the number of units sold) on the register. This involves dividing the fixed costs by the contribution margin ratio.

Break-Even Dollars = Fixed Costs/Contribution Margin Ratio

For our sub-business, the contribution margin ratio is ⅖, or 40 cents of each dollar contributes to fixed costs. With $20,000 fixed costs/divided by the contribution margin ratio (.4), we arrive at $50,000 in sales.

Therefore, we can break even if we ring up $50,000 in sales.

Difference Between CVP Analysis and Break-Even Analysis

Cost Volume Profit (CVP) analysis and break-even analysis are sometimes used interchangeably, but in reality, they differ because break-even analysis is a subset of CVP.

CVP is a comprehensive analysis that examines the relationship between sales volume, costs, and profit to determine break-even points and profit targets.

It considers various factors, such as:

- Sales price

- Costs

- Sales mix

Break-even analysis only identifies the sales volume required to break even. It is a subset of CVP analysis focused on finding a situation where total revenue equals total costs, resulting in zero profit or loss.

It helps determine the minimum sales volume needed to cover costs.

The real-world business dangers of CVP analysis

The dangers of not doing a CVP analysis are instantly clear. In a real-world example, the founder of Domino’s Pizza, Tom Managhan, faced an early problem involving poorly calculated CVP in his book “Pizza Tiger”.

The company was providing small pizzas that cost almost as much to make and just as much to deliver as larger pizzas. Because they were small, the company could not charge enough to cover its costs.

At one point, the company’s founder was so busy producing small pizzas he did not have time to determine that the company was losing money on them.

On a separate note, according to industry experts, real-time CVP analysis was crucial during COVID-19, particularly in industries such as hotels, just to keep the lights on.

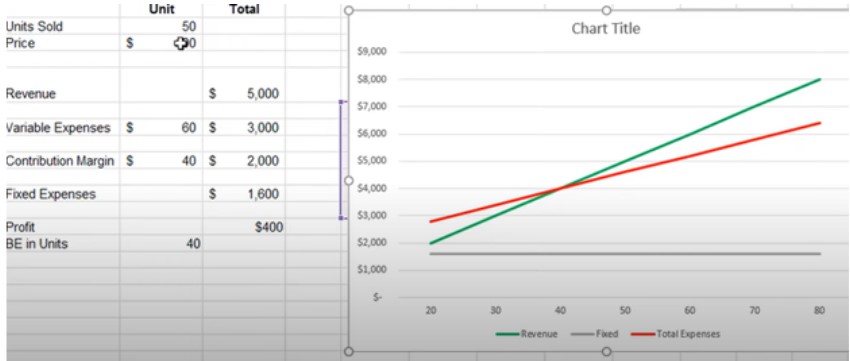

Plotting the CVP Graph

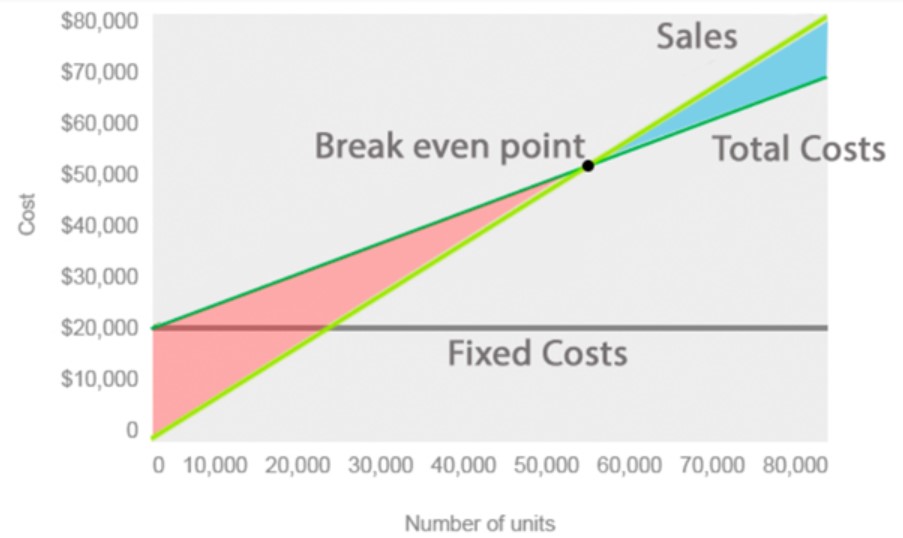

The cost-volume-profit chart, often abbreviated, is a graphical representation of the cost-volume-profit analysis.

In other words, it’s a graph showing the relationship between the cost of units produced and the volume produced using fixed costs, total costs, and total sales.

It’s a clear and visual way to tell your company’s story and the effects when changing selling prices, costs, and volume.

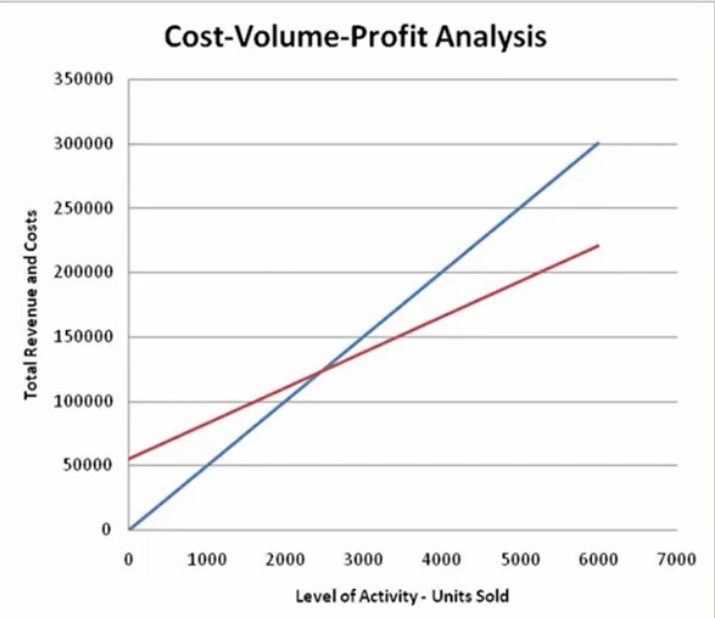

On the X-axis is “the level of activity” (for instance, the number of units). On the Y-axis, we place sales and total costs. The fixed cost remains the same regardless.

The point where the total costs line crosses the total sales line represents the break-even point. This is the point of production where sales revenue will cover production costs.

The above graph shows the break-even point is between 2000 and 3000 units sold.

For FP&A leaders, this cost accounting method can show executives the margin of safety or the risk the company is exposed to if sales volumes decline.

For instance, the CVP can show an executive that in an economic downturn, the company is at risk of losing money on sales of this product because it has a higher level of risk due to its lower margin of safety.

In conjunction with other types of financial analysis, leaders use this to set short-term goals that will be used to achieve operating and profitability targets.

CVP Analysis Limitations

Like all analytical methodologies, CVP analysis has inherent limitations.

This includes challenges for CVP analysts when identifying what should be considered a fixed cost and what should be classified as a variable cost. Some fixed costs do not remain fixed indefinitely.

Costs that once seemed fixed, such as contractual agreements, taxes, and rents, can change over time. Further, assumptions made surrounding the treatment of semi-variable costs could be inaccurate.

Therefore, having real-time data fed in with a solution such as Datarails is paramount.

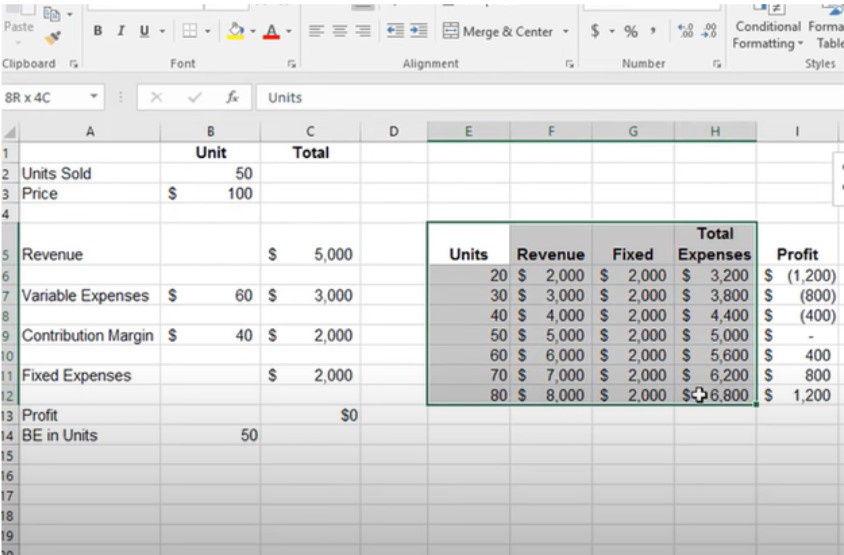

With that all said, for most, the best way to do a CVP analysis is to use Excel.

To build a chart first input the “juicy data” (price, variable expenses, contribution margin). In the “insert” tab, choose a line chart. Select the data and edit the graph appropriately to change to correct the labels.

This visual line chart tells your story clearly outlining revenue, fixed costs, and total expenses, and the breakeven point.

Using Datarails, a Budgeting and Forecasting Solution

CVP is a tried and tested method for businesses.

Datarails is a budgeting and forecasting solution that integrates such spreadsheets with real-time data.

It integrates fragmented workbooks and data sources into one centralized location. This lets you work in the comfort of Microsoft Excel with the support of a much more sophisticated but intuitive data management system.

Plugging into your financial reports ensures this valuable data is updated in real-time.

Everything you have built or can build in Excel is available through Datarails, which provides security and efficiency (and no more copying, formatting, and pasting).

We do the mapping and updates (normally hours of manual work), and the system automatically updates.

For instance, simple CVP analysis is automatically updated in a PDF presentation in real-time through Datarails.

Did you learn a lot about cost-volume-profit analysis in this article?

Here are three more to read next:

Customer Acquisition Cost (CAC): Definitions, Formula, & More

Excel vs. Google Sheets: Which One is Better?

6 Budget Monitoring Strategies to Integrate in Your Marketing Plan