In today’s world of finance and business, the need for accurate and timely financial information cannot be understated. Financial consolidation, an essential process that allows businesses to combine financial data from multiple entities into consolidated financial statements, is of utmost importance.

If a parent company manages multiple entities, operates across multiple currencies, and follows Generally Accepted Accounting Principles (GAAP), this process is as complex as it is critical. However, in recent years, there have been several advances in technology to make this process more streamlined.

Financial consolidation software has become a game-changer, streamlining the consolidation process, improving financial reporting, and offering significant benefits to internal and external shareholders.

Financial consolidation software not only automates the production of key financial reports like the Income Statement and Balance Sheet, but it also helps to facilitate performance management at both the corporate and full enterprise levels. The most difficult decision now is not whether to use financial consolidation software, but what software to use.

Several financial consolidation software options are available on the market, and finding the option that fits your business’s unique needs can be overwhelming.

In this article, we’ll dive into the world of financial consolidation, understand its process, and distinguish financial consolidation from financial close. We’ll examine the benefits of using financial consolidation tools and present seven of the best software choices available today, including Datarails, Centage, Repohop, Board, Workiva, OneStream, and Layer. Each piece of software will get its own in-depth look, identifying which software is best suited for whom.

What is financial consolidation software?

Financial consolidation software is a specialized tool designed to simplify and automate the complex process of financial consolidation. The process involves gathering financial data from multiple entities within a company or group of companies, and using that data to create a unified, comprehensive view of the entire organization’s financial health.

Financial consolidation often involves dealing with multiple currencies, diverse accounting standards, intercompany transactions, and various other issues. The need for software is clear, as compiling all of that data by hand is a tedious and difficult process, prone to errors. With financial consolidation software, time spent is significantly reduced, and potential inaccuracies from manual calculations are minimized or removed.

Many software products will also automatically adjust for currency differences and align financial data according to the Generally Accepted Accounting Principles (GAAP), eliminate intercompany transactions, and ensure the consolidated financial statements accurately reflect the organization’s financial status. In addition, the software will streamline the generation of key financial reports like income statements and cash flow statements, enhancing financial transparency for internal and external stakeholders.

Furthermore, financial consolidation software often comes with advanced features to aid in financial planning, performance management, and enterprise performance management.

Those features are excellent at providing strategic insights into the company’s performance, help with decision-making, and identifying areas for improvement.

Financial consolidation software can be a powerful tool that not only simplifies and automates the consolidation process, but can also provide valuable insights to drive further business growth.

How to do the Financial Consolidation Process

The financial consolidation process, which finance or accounting managers often oversee, involves several intricate steps. While the process may vary based on the organization’s structure and software utilized, here is a general guideline:

- Data Collection: The first step involves gathering financial data from all entities, subsidiaries, or business units within a parent company – this includes income statements, balance sheets, and cash flow statements.

- Currency Conversion: All financial data must be converted into the parent company’s currency if the business operates in multiple countries. This step is necessary to ensure consistency and comparability across all entities.

- Adjustments and Eliminations: Next, adjustments are made to align the financial data with GAAP. This includes eliminating intercompany transactions and balances to avoid double-counting and adjusting for different accounting methods used by different entities.

- Consolidation: After making the adjustments, the financial data from all entities are consolidated into a single set of financial statements. The consolidated data provides a holistic view of the company’s financial position and performance.

- Analysis and Reporting: The final step involves analyzing the consolidated data and preparing financial reports. These reports are then used to inform strategic decisions and communicate the company’s financial status to internal and external stakeholders.

Companies can automate and streamline this complex process by leveraging financial consolidation software, increasing efficiency, reducing errors, and enhancing financial transparency.

What’s the Difference Between Financial Consolidation and Financial Close?

Both financial consolidation and financial close are a part of the financial reporting cycle; however, they are both distinct, albeit interconnected, processes in corporate financial management. Below we will define each process.

Financial Consolidation

Combines financial data from various departments or subsidiaries within a parent company into consolidated financial statements. The aim is to present a unified view of the company’s financial performance and status, and the process includes collecting and harmonizing financial data, adjusting for discrepancies, and converting foreign currencies, all to meet the Generally Accepted Accounting Principles (GAAP).

Financial Close

Commonly known as the “month-end close,” this process occurs at the end of each reporting period, which can be monthly, quarterly, or annually. It involves finalizing all the accounting records of a company for that period, including verifying and adjusting account balances, reconciling discrepancies, and preparing individual financial reports for each entity. This financial close process must be completed before financial consolidation can occur.

Breaking it down, both financial consolidation and financial close are sequential steps in the overall financial reporting process. The financial consolidation software often includes functionalities to aid with both, which can streamline the transition from financial close to financial consolidation, all while ensuring data accuracy and GAAP and regulatory compliance.

Check out our comparison guide of the top financial close software.

Benefits of Using Financial Consolidation Software

Financial consolidation software has many benefits for businesses, especially those that span multiple entities, currencies, or have complex financial data. Here are some of the key advantages:

- Efficiency and Time-Savings: Manual financial consolidation is time-consuming and extremely error-prone, particularly for complex organizations. Consolidation software automates much of the process, drastically reducing the time required and minimizing human error.

- Compliance and Accuracy: The software ensures consolidated financial statements adhere to GAAP and other relevant regulations. It will automatically take care of adjustments, improving the accuracy of reporting.

- Unified Real-Time Data: The software offers a single source for financial data across all entities, providing real-time insights and aiding in informed decision-making. This is invaluable information for finance managers and other internal and external stakeholders.

- Improved Financial Reporting: When consolidation is automated, the quality of financial reports will likely improve, and it also facilitates multi-entity financial reporting. The software often comes with built-in reporting tools for key financial reports, including consolidated balance sheets, income statements, and cash flow statements.

- Scalability: As a business grows, complexity will grow in tandem. Consolidation software is scalable, making it feasible to manage increased data volume and thereby supporting business growth.

By streamlining the consolidation process and ensuring regulatory compliance, financial consolidation software is an essential tool for modern corporate performance management.

7 Best Financial Consolidation Software

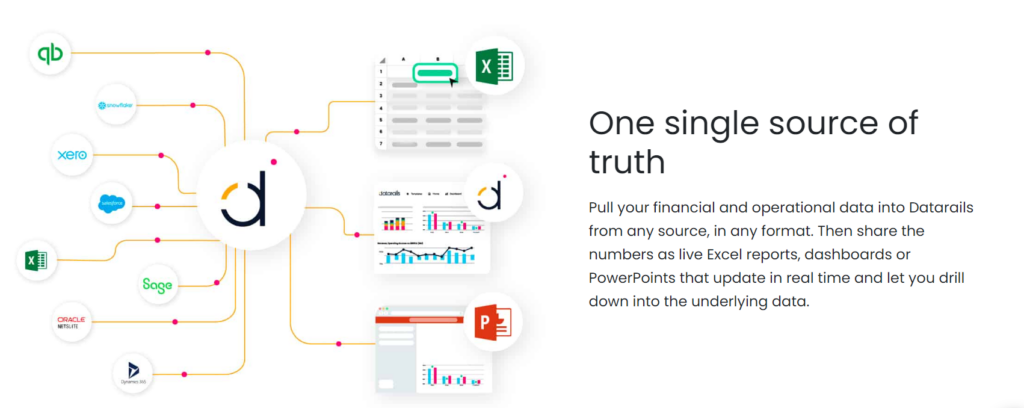

Datarails

Who They Are: Datarails is a Financial Planning & Analysis (FP&A) software solution that enhances Excel’s capabilities for finance departments. It offers robust financial consolidation tools designed to help professionals manage and streamline their financial processes.

Features: The software offers budgeting and planning tools, financial forecasting, variance analysis, and automated report generation. It uses Artificial Intelligence (AI) and machine learning algorithms to provide predictive analytics and financial insights.

Pricing: Specific pricing details are not fully available, as they offer tailored solutions to fit the needs of different businesses. Plans start at $2,000 per month.

Pros: Datarails integrates directly with Excel, offering a familiar interface for users. It also offers advanced features like AI-based financial forecasting.

Cons: There may be a learning curve for users not familiar with Microsoft Excel.

Best For: Datarails is best suited for small to medium-sized businesses that rely on Excel for their financial processes.

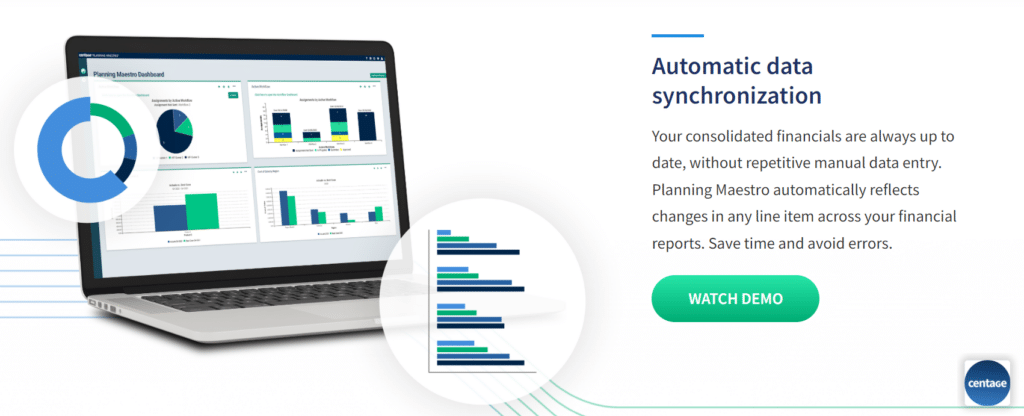

Centage

Who They Are: Centage is more than just a financial consolidation software, it is a comprehensive budgeting and financial forecasting tool designed with small to midsize businesses in mind. Its primary mission is to facilitate efficient financial planning and decision-making, allowing businesses to navigate complex financial landscapes with greater ease and confidence.

Features: The software offers automated budgeting and forecasting, financial reporting, and consolidation. It also includes scenario modeling and dashboard features.

Pricing: Centage operates on a quote-based system, meaning you’ll need to contact the company for specific pricing information. Pricing starts at $5 per user per month, for small businesses under 25 employees.

Pros: Comprehensive budgeting and forecasting tools, user-friendly interface, and strong customer support.

Cons: Set-up time and customization can take some time, according to the specific business needs.

Best For: Small to mid-sized businesses looking for an all-in-one financial management solution.

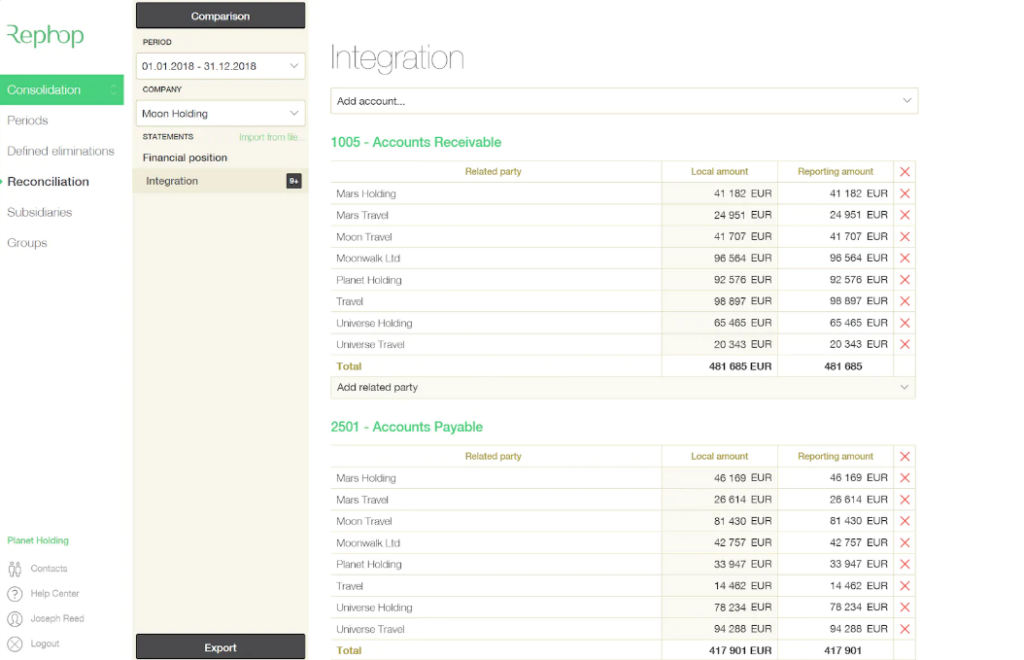

Rephop

Who They Are: Rephop is a specialized software provider with a focus on simplifying the financial consolidation and reporting process. They have designed their software to tackle the complexities and challenges of financial consolidation head-on. Businesses can automate their consolidation tasks with Rephop, reducing the time and effort required to generate consolidated financial reports.

Features: The software provides automated consolidation, multi-currency support, and a user-friendly interface.

Pricing: As you can see from the list so far, pricing information is generally not available, including with Rephop. They will provide you with pricing information directly when you contact them.

Pros: Automation of complex consolidation tasks, intuitive user interface.

Cons: Might lack advanced features that are offered by other providers.

Best For: Businesses looking to automate and streamline their financial consolidation process.

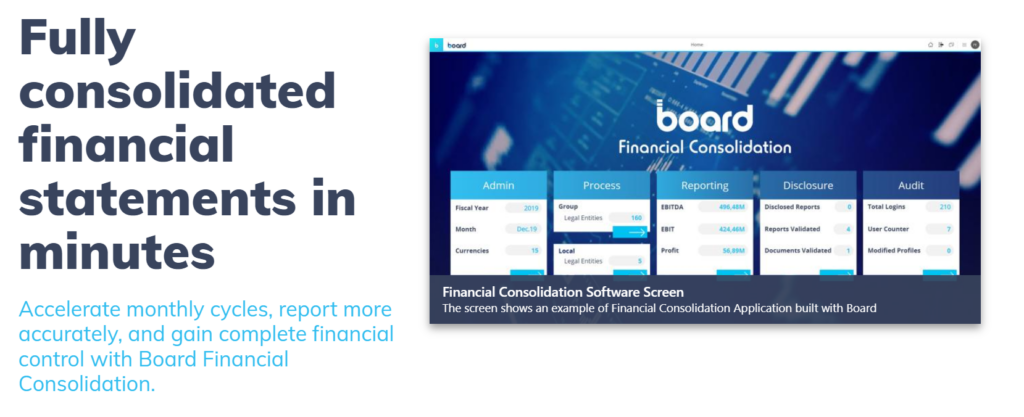

Board

Who They Are: Board is a financial software decision-making platform that integrates business intelligence tools with corporate performance management capabilities. The design of the software is to provide businesses with all the tools they need to make informed financial decisions, including budgeting and planning all the way to financial consolidation and reporting.

Features: Includes budgeting, planning, forecasting, financial consolidation, reporting and analysis, and scorecards.

Pricing: Pricing information is not publicly available, direct contact is needed.

Pros: Comprehensive suite of tools for decision making, good customer support.

Cons: May be overkill for small businesses with simpler needs.

Best For: Mid-sized to large businesses looking for a robust financial decision-making platform.

Workiva

Who They Are: Workiva provides a collaborative platform designed for teams to connect, prepare, and report their financial data. It is not just a tool for financial consolidation but includes a comprehensive solution that addresses all aspects of financial reporting and compliance. Workiva is ideal for enterprises that require a robust, collaborative tool for managing and reporting financial data.

Features: A comprehensive suite of tools for data collection, data connection, reporting, and compliance.

Pricing: Not available without direct contact, customized for the client.

Pros: Strong collaborative tools, good for managing and reporting complex financial data.

Cons: May have a steeper learning curve due to its comprehensive nature.

Best For: Larger enterprises with complex reporting and compliance needs.

OneStream

Who They Are: OneStream is a financial software provider with a unified smart platform for financial consolidation, planning, reporting, and analysis. Their software is designed to simplify and streamline financial processes, eliminating the need for multiple disjointed financial systems. Suitable for all sizes of businesses, from small businesses to large multinational corporations.

Features: The platform provides financial consolidation and reporting, budgeting and forecasting, and data quality management tools.

Pricing: Not publicly disclosed, customized for the client.

Pros: Unified platform for all financial tasks, user-friendly, and robust customer support.

Cons: Setup and customization can be a lengthy process.

Best For: Businesses of all sizes looking for a unified solution for their financial tasks.

Layer

Who They Are: Layer is a financial consolidation software that stands out for its simple, intuitive design. Layer focuses on providing a user-friendly interface and efficient financial consolidation and reporting tools. Their software is designed to simplify the consolidation process, making it easier for businesses to generate financial reports and make data-driven decisions.

Features: Tools for financial consolidation, reporting, and data analysis.

Pricing: Not publicly disclosed, contact directly for a quote.

Pros: Streamlined data analysis and consolidation features, easy-to-use interface.

Cons: Some users might find the lack of advanced features limiting.

Best For: Businesses of all sizes looking for efficient data consolidation and reporting.

Summary

Financial consolidation is an essential and complex process that often requires many hours and late nights. However, financial consolidation software can help streamline the necessary steps to consolidate financial information and make this once laborious task routine.

In this article, we dove into the world of financial consolidation, the benefits of using financial consolidation software, and the seven best software choices for financial consolidation. With this information, businesses can determine which software is best suited for their needs.