AI Finance Tools are providing finance teams more accurate data as well helping them be more productive. AI that is built for finance allows leaders to make real-time decisions and drastically improve their planning and forecasting.

From financial data analysis to budgeting and forecasting, from tax and compliance to accounting, these advanced AI finance tools empower finance teams to focus on strategic decision-making and value-added activities.

With the recent focus on AI, companies are scrambling to find the most efficient ways to automate their finance departments and stay ahead of the competition. In this article, we’ll go over the top eight AI tools for finance teams and how they are reshaping the finance industry by streamlining processes and eliminating manual work.

Note: This article covers AI finance tools for finance professionals. For individuals looking to improve or automate their own finances and investing – good for you! It’s very important. However, this article is meant for finance teams and companies.

How is AI Changing Finance and Accounting?

Many people are worried that AI will completely change finance and even take their jobs. While it might make some manual work obsolete, the reality is AI is just another tool in helping finance professionals do their work.

In fact, we don’t need to look too far to see a similar occurrence – the invention of Excel. Before digital spreadsheets, accountants used to do everything by hand. Fixing and calculating numbers on paper was the vast majority of their work.

When Excel was invented, many finance professionals were worried it would take their job. While many bookkeepers were replaced in the short term, in reality it allowed finance people to do more strategic work and they became far more valuable.

AI is predicted to have a similar outcome. Here are a few ways it will automate and change finance and accounting:

- More realistic forecasts

- Automated data management

- Mergers and Acquisitions (M&A) due diligence

- Faster and more acurate financial analysis

You can read more here about FP&A salaries, careers, and the average pay.

Best AI Finance tools for Finance Departments

1) Datarails FP&A Genius

Who is FP&A Genius meant for:

- CFOs and FP&A analysts

Datarails has long been a pioneer of automating manual work and empowering finance professionals to focus on their strategic value.

With the release of FP&A Genius, the ChatGPT style Chatbot for finance professionals, Datarails took their automation to the next level. As finance professionals know, management loves asking “what if” and scenario questions, and FP&A Genius allows them to be answered accurately and far quicker than ever before.

Let’s say you’re in a management meeting and the CEO asks a question that you didn’t specifically prepare for (an all too common scenario). Instead of having to sift through spreadsheets you can type in the question to the AI chatbot and you will receive a data-driven answer within a few seconds.

You can even present it with graphs and visuals with the new feature called Storyboards.

Here are a few highlights of FP&A Genius:

- Connected to real time data – The Datarails chatbot is connected to data in real time, which ensures that each decision is based on the most accurate and up to date information.

- Single source of truth – Like Datarails itself, FP&A Genius connects all of the company’s finance integrations and data sources into one source of truth.

- Secure data – Unlike ChatGPT and other AI programs, the data that comes from the Datarails’ chatbot is secure and based on trusted and secured sources.

- Dashboards and visuals – As part of the responses, FP&A Genius provides dashboards and visuals. This helps tremendously when showing the answers to management, as the visuals are straightforward and don’t have to be created in PowerPoint.

FP&A Genius is an AI tool that has the potential to completely disrupt the FP&A industry, as data is pulled up and questions are answered instantly, accurately, safely, and even with visuals and dashboards to help with reporting.

FP&A Genius Pricing:

- Part of the complete Datarails’ FP&A software package. Pricing varies based on customized pricing options.

2) Domo

Who is Domo meant for:

- Data analysis and integration.

With its inception in 2010, Domo emerged as a trailblazer in the realm of data analysis and integration.

Domo’s expertise lies in seamlessly integrating data from diverse sources, consolidating them into a unified and user-friendly dashboard tailored for business decision-makers.

Domo automates business insights through low code and pre code apps, BI and analytics through intuitive dashboards, and of course integrations of real time data from anywhere.

At the heart of their mission is addressing the challenges of outdated, siloed, and non-real-time data. While most finance teams just miss out on this data, Domo empowers teams by providing a single dashboard that effortlessly aggregates data from Excel, Salesforce, Workday, and over a thousand other apps and finance tools. As Domo is a data connector rather than a data generator, the data is trusted and accurate.

Their easy to use dashboard is meant for anyone to be able to contribute to, while still offering advanced capabilities that enable technical teams to respond quickly to business needs.

Being that Domo has been a pioneer in the AI field for a while (since 2010), it has also been addressing the worry that AI may replace financial analysts for quite some time. In this case, Domo states that they want to empower employees to make better and more strategic decisions rather than replace them. This is because Domo advertises the software as a connector, not a data generator.

Domo pricing:

- Customized pricing based on the amount of data and number of users.

3) Finnt

Who is Finnt meant for:

- Mid-market corporations

Unlike many of the tools on the list, Finnt was built as an AI-first tool and is AI native. Finnt wants finance professionals to be able to spend their time analyzing data and recommending strategies rather than using all their efforts to gather and crunch data.

Finnt focuses on specific tasks in accounting, controllership, and finance operations, including:

Revenue recognition and analysis, bad debt, depreciation and amortization, and more.

Finnt works by creating custom workflows for client specific needs and use cases. These workflows involve a rigorous process of data ingestion (Excel, CSV, PDF files), data mapping, and output formatting. They are all tailored towards automation and outsourcing of tedious, manual, and repetitive tasks. Finnt even has an AI assistant to retrieve and include additional personalized information in the final reports.

Finnt pricing:

- Pricing is based on usage and customizable packages. Contact them for a demo and sales quote.

4) Booke.AI

Who is Booke AI meant for:

- Bookkeeping and Accounting

Booke leverages AI to automate bookkeeping in the finance team. It fixes uncategorized transactions and coding errors, allows for better client communication, and automates more of your work.

Some of the benefits of Booke include:

- Effortless month-end close – Not only does Booke automate the bookkeeping aspect of the month-end close, it also finds and fixes errors in your bookkeeping with advanced error detection technology.

- Better client communication – You can streamline your collaboration with clients and get faster responses with their user-friendly portal.

- AI Driven Categorization – Booke becomes more accurate with its categorization as time goes on, and has 80% faster transaction categorization.

- Two way integrations – Connects to important bookkeeping software like Xero, QuickBooks, and Xoho Books.

- Extracting data – Booke allows you to extract data from receipts in real time, even in bulk.

Booke AI pricing:

- The Data Entry Automation Hub is priced at $20/month, or $18/month on an annual plan. The Robotic AI Bookkeeper plan is priced at $50/month per user on a monthly plan or $45/month on an annual plan.

5) Stampli

Who is Stampli meant for:

- Accounts Payable

Stampli is an AI-driven tool designed to streamline the accounts payable process, ensuring your finance team works efficiently and effectively. Stampli works with your existing ERP systems, including QuickBooks, NetSuite, and Sage Intacct. This ensures a seamless and integrated solution for your invoicing needs.

Some of Stampli’s key features include:

AI-powered data extraction: Stampli uses AI to automatically extract and organize data from your digital invoices, reducing manual labor and errors.

Interactive Invoice Management: The platform allows users to communicate directly on invoices, boosting collaboration and transparency within teams.

Real-time Audit Trails: With Stampli, you can monitor every action on an invoice in real-time, providing insight and control over your financial operations.

AI-Powered Insights: Stampli’s smart technology is capable of learning your unique patterns and vendor behaviors, providing you with predictive insights that can help optimize your invoice management.

Stampli is made for finance teams of any size looking for an intelligent and efficient solution for managing their invoices. Stampli’s advanced features and AI capabilities can help streamline your accounts payable process and improve your financial control.

Stampli pricing:

- Stampli doesn’t provide pricing on their website but they offer flexible pricing options (monthly or annually) and include onboarding and support in their initial quote.

6) Nanonets

Who is Nanonets meant for:

- Accounts payable

Nanonets Flow is an innovative platform that uses AI to make finance tasks easier. It helps finance professionals by automating complex processes, so they can focus on making important decisions and growing their business.

One of the key features of Nanonets Flow is its ability to extract important information from documents like invoices, receipts, and bank statements. It uses advanced technology to accurately gather and organize financial data, saving time and reducing errors caused by manual entry.

Nanonets Flow goes beyond just extracting data from documents. It also automates processes, manages workflows, and seamlessly integrates with existing financial systems and accounting software. This all-in-one solution helps finance professionals streamline their work, boost efficiency, and achieve better financial results.

According to the website, Nanonets “processes invoices 10 times faster” and has “no fees for Automated Clearing House (ACH) or card payments”.

Nanonets Flow Pricing:

Starter Plan – $49/user/month ($199/mo fixed price for 5+ users)

Pro Plan – $69/user/month ($499/mo fixed price for 10+ users)

Plus Pan – $99/user/month (Contact to get a customized plan)

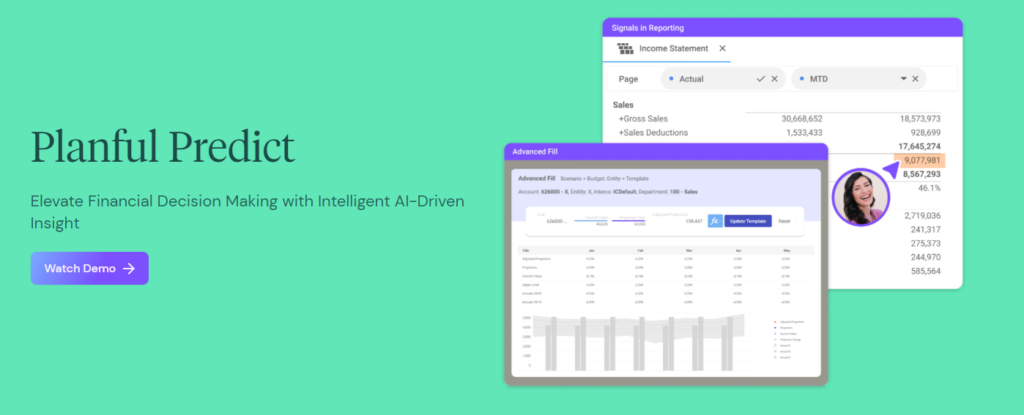

7) Planful Predict

Who is Planful Predict meant for:

- FP&A and CFOs

Like FP&A Genius, Planful Predict is a tool as part of FP&A software that is meant for high level CFOs and CEOs. It helps make faster and more accurate decisions, as it takes the place of time-consuming number-crunching and reporting.

Predict combines the data integration of FP&A tools along with AI and Machine Learning to give the most accurate performance and suggestions for driving the business.

While Datarails FP&A Genius provides dashboards and visualizations to go along with the AI generated answers, Planful Predict focuses on the weak spots in their company’s financials through Planful Predict: Signals.

“Predict: Signals empowers users to take corrective action by surfacing variances and anomalies in data with AI-driven anomaly detection.”

Planful Predict Pricing:

Planful Predict is part of Planful’s platform and yearly contract. They don’t provide pricing on their website but customized quotes are available.

8) Trullion

Who is Trullion meant for:

- Accounting teams, specifically compliance and audit.

Trullion uses AI to connect structured and unstructured data together into one platform. This allows finance teams to minimize cost inefficiencies, ensure up-to-date compliance, and save time through automating the accounting process.

Here are a couple of Trullion’s key features:

- Audit – With Trullion, you can access all your data sources in a single location. In addition, the auditing function allows users to effortlessly compare transactions or supporting documents from anywhere, at any time. Save valuable time by conducting audits in a “fraction of the time”.

- Lease Contracts – Lease contracts are an increasingly time-consuming process for most companies. Leasing is a popular form of contract management and everything from employees’ personal computers to office contracts are done through leases. This leads to many problems with paper trails and tracking. Trullion’s AI empowers you to extract essential data from lease contracts, regardless of their format and effortlessly generate audit-ready reports.

- Revenue – Trullion upgrades your company’s revenue collection and reporting by seamlessly connecting and managing your CRM, billing, and contract data. Automate the workflow and efficiently handle your revenue recognition with ease. Most importantly, it accelerates the time to close.

Trullion Pricing:

- No pricing is provided on the website but various sources put the starting price at $3,000 per year.

9) Vena Insights

Who is Vena meant for:

- Financial planning and analysis and sales performance management,

Vena Insights helps teams use data to make the most informed decisions when it comes to things like budgeting and forecasting, workforce planning, incentive compensation management, tax provisioning, and much more. It uses world-class AI and machine learning to do so, and users like that they don’t need to switch between tools or export data to separate applications to access what they need.

Here are some of Vena Insights key features:

- Dashboards – Vena makes it easy for users to make their own dashboards that they can customize to include only the data they need and it also allows them to visualize the data in a way that works best for them.

- Predictive Analytics and Anomaly Detection – Users can make more informed and empowered decisions knowing they have the data they need to improve their forecast accuracy, spot unusual patterns, and make the most scalable predictions.

- Data Analysis Expressions (DAX) – Users can leverage Vena Insights robust calculation engine. It has a flexible formula language in Data Analysis Expressions (DAX) that lets you create calculated functionalities to uncover fresh insights within your data model.

Vena Insights pricing:

- Contact Vena for specific pricing details. Offers Professional and Complete plans. Special pricing is available for non-profit organizations.

Conclusion

Finance has traditionally been one of the most manual and repetitive departments within organizations. Thanks to AI, finance professionals will be able to focus more on data driven and strategic decision making activities and less on repetitive and manual work in 2024.

These eight finance tools are great examples of how AI is improving all aspects of finance. No matter what the industry is or the size of the business, there is some way that AI tools can improve the finance department in your company.