ChatGPT is one of the numerous applications that can be used for AI in finance. Although not specifically meant for finance, ChatGPT can do a lot to help cut down on manual work and other aspects of finance. ChatGPT and other tools extend to virtually every part of a finance team’s responsibilities.

This article will go over how to use ChatGPT in finance and some of the issues it can solve.

Introduction

Within just two months of its launch in 2022, ChatGPT reached 100 million active users, making it the fastest-growing application in history.

Many industries quickly adopted AI and machine learning, and finance was no exception. In fact, a 2022 survey found that 78% of banks and other financial institutions had already adopted some form of AI.

The fact AI systems like ChatGPT are being embraced and adopted so fast in finance is a sign they will fundamentally affect how things are done and how service is provided and functions are performed throughout the industry.

Learn more about AI in finance in this article.

How to Use ChatGPT in Finance

Here are some common financial use cases for ChatGPT:

Report Generation

Automating the generation of financial reports saves finance teams time and allows them to dig deeper for more valuable insights.

Generating financial reports is one of the most labor-intensive tasks in finance. Fortunately, modern technology usually automates this task.

ChatGPT can analyze data and automatically generate summaries, trends, and key insights about a company’s business.

Automating the report-generation process allows finance teams to spend more time doing strategic analysis, which benefits from human judgment.

ChatGPT can speed up the frequency at which companies generate reports, allowing them to stay nimble and respond faster to shifting market conditions.

Extracting Insights from Text Data

ChatGPT also helps finance professionals extract insights from large amounts of textual information.

A simple Google search can unearth a large amount of textual information, such as articles, analyst reports, presentations, etc. Manually sifting through this data isn’t the best use of employees’ time when there is a far more efficient option.

ChatGPT solves the problem of sifting through this enormous amount of information to detect market sentiment, which would otherwise be too challenging for mere humans.

Automated textual analysis allows finance professionals to extract useful information to help them understand recent developments and trends.

This helps them make timely and informed decisions. Further, textual analysis also helps identify potential threats or opportunities for a firm when they arise.

An AI-powered FP&A question-answering tool saves time when acquiring intelligence.

Using a question-answering tool that pulls together information from financial data, users can quickly get insights based on the metrics they are interested in.

These could be requests for any metric a team keeps, any market, or any investment opportunity. Acquiring prompter information, especially in fast-moving markets, is a significant competitive advantage.

Multidimensional Interactive Data Analysis

ChatGPT can be used to develop interactive systems to analyze specific questions and visualize the results. In finance, adding interactivity allows managers to query multiple key indicators rather than see the data linearly.

Enabling multiple perspectives can also help users make more insightful decisions.

Teams performing multidimensional analysis and data visualization can engage in cross-checking processes to strengthen their decision-making.

Automate Customer Interactions

Automating interactions with customers can improve service efficiency and customer satisfaction. ChatGPT can power chatbots that provide customers with information about financial data, such as current account balances or transaction history.

Automating these interactions can improve customer service, reduce response times, boost customer satisfaction, free human representatives to deal with more complex issues, and improve overall operational efficiency.

Check out The Complete Guide to AI in FP&A next.

Forecasting Narratives

Narratives help stakeholders understand why something happened. By creating narratives that outline forecasted financial numbers, finance teams can more easily use these forecasts to position themselves for future opportunities and challenges.

ChatGPT can add color and context to numbers, enabling finance professionals to better understand and explain forecasts to their teams and stakeholders.

Generating narratives will also help explain the strategic plays and the corresponding outcomes, creating better team alignment and understanding.

Learn how Datarails’ scenario modeling prepares you for the best-case scenario, the worst-case scenario, and everything in between.

Translating Financial Jargon

Complex financial terms that are second nature to a finance team may be unfamiliar to clients and stakeholders. Fortunately, ChatGPT can translate technical jargon into plain language.

Many financial concepts can be explained using simpler words, allowing financial experts to bypass the jargon barrier and communicate more effectively with their clients. This is particularly useful for improving relationships with clients and other important stakeholders.

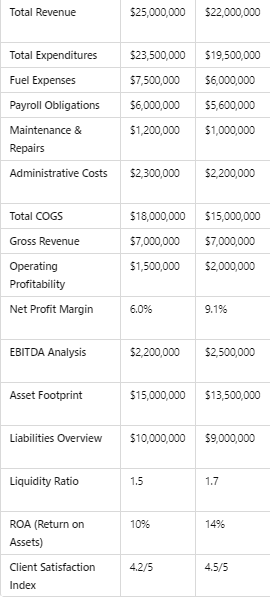

For example a report such as this:

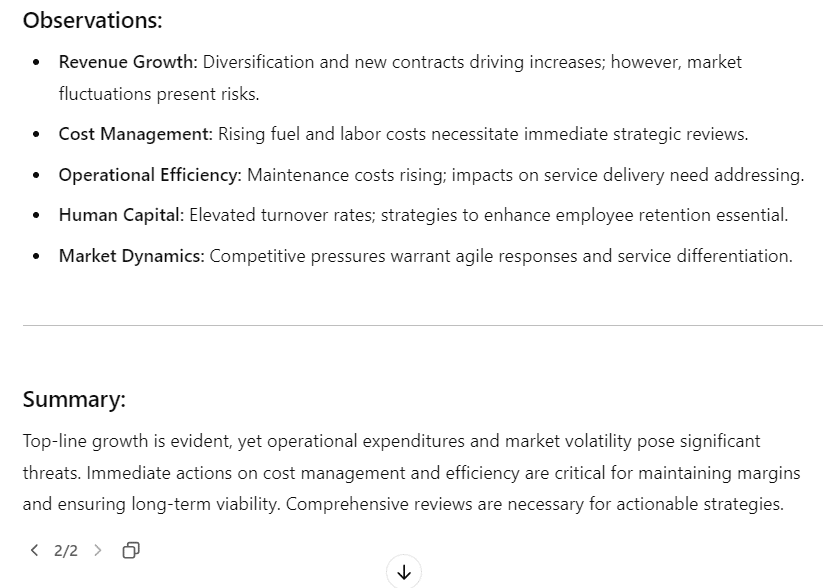

Can be summarized easily in ChatGPT into something like this:

Training and Simulation

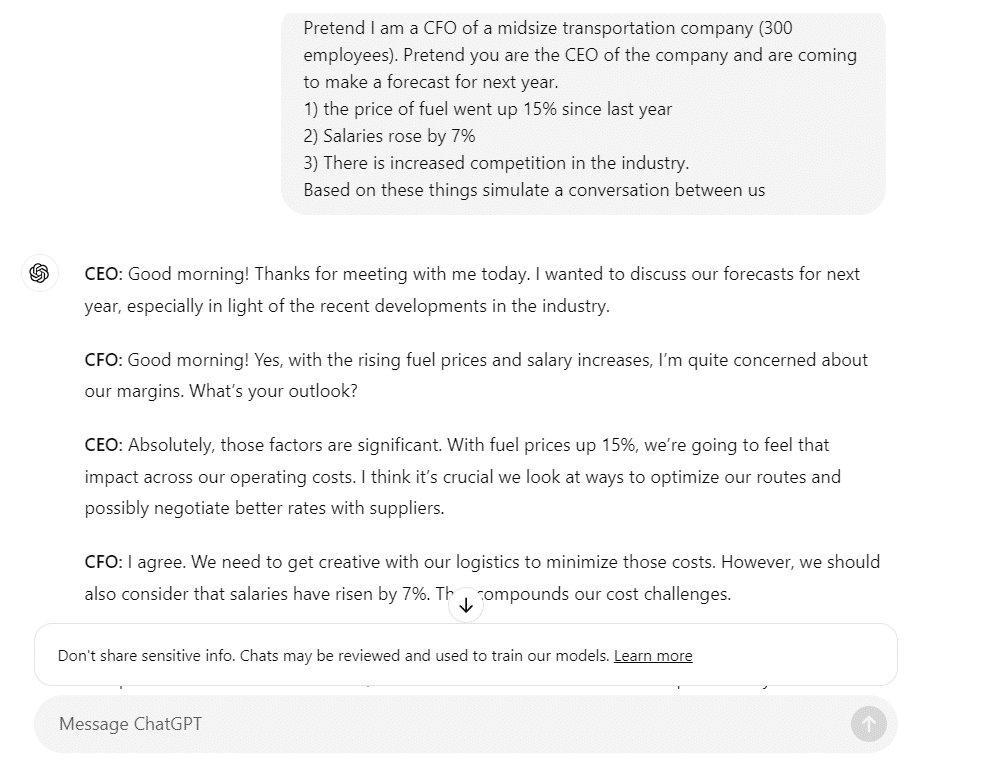

You can use ChatGPT for training purposes to prepare your teams for real-life situations.

For example, it can simulate conversations in which finance professionals need to handle professional challenges or financial problems they might face.

ChatGPT provides a good opportunity for training your finance professionals to think of suitable responses in a safe environment.

GPTs for Finance

GPTs are being developed for specific financial needs, such as financial planning and forecasting or this FP&A advisor.

Implementing ChatGPT in Finance

Integrating ChatGPT into financial operations requires a strategic approach that considers various factors.

Here are six key considerations during the implementation process.

1. Upskill Your Finance Team

Help them learn the data (and AI) skills they need to perform their current roles well. This will prepare the team to make the most of ChatGPT in finance.

2. AI Ethics

Discussing AI ethics within training is crucial so staff understand why they need to understand bias, transparency, and accountability issues.

If finance services are to be delivered with AI tools, they must carefully navigate those ethical issues and comply with relevant regulations.

3. Updating Learning

The finance industry’s nature means that the latest technology can develop rapidly. Teams must regularly share the latest AI developments with them to ensure they remain competitive and can use new tools and techniques.

4. Define Use Cases Clearly

For ChatGPT to work to its full potential, identify the specific tasks in the financial functions for which ChatGPT’s abilities can be used.

This might be to automate customer questions, produce a financial report, or spot trends in market data. Once you have determined these use cases of ChatGPT, it will provide a clear path for designing the implementation, as your team will know what tasks to focus on.

If the technology is used intentionally rather than just because it exists, it can deliver far more cost-effective and measurable results to your business.

5. Integration with Existing Systems

Before deploying ChatGPT, assess its compatibility with your existing technology. Evaluate current software systems, databases, and workflows to ensure they can integrate with the AI tool.

Effective integration ensures ChatGPT has the necessary data and can work with other tools the finance team already uses. This might require some conversations with the IT department to ensure a smooth onboarding process and iron out the data flow processes.

Successful integration means the transition is seamless, the tech stack doesn’t require a complete overhaul, and teams can begin using ChatGPT without reworking existing systems.

6. Scalability

Planning how ChatGPT can be scaled involves determining its capacity to process more complex tasks or more extensive data sets in the future and considering potential expansion so the solution works in the long run.

Wondering if AI will replace accountants? Find our predictions here.

Challenges in Implementing ChatGPT in Finance

Alongside ChatGPT’s benefits, organizations might face adoption challenges they must address.

These include:

Data Privacy and Security

Financial information is sensitive and must be protected. To maintain the trust of clients and other stakeholders, ensure your organization meets data protection requirements and regulations.

Data Quality and Quantity

An AI system’s output is only as good as its input. Organizations must ensure top-quality data inputs have been collected. They would be remiss if they allowed biases and inaccuracies in their data that would lead to false conclusions.

Technical Skills

The organization will have to train its personnel to use AI tools correctly. Otherwise, your team cannot utilize ChatGPT to its full potential. You also risk data errors and inaccuracies that can have profound repercussions across your organization.

Final Thoughts: Can ChatGPT Solve Finance Problems?

ChatGPT is a substantial help to finance professionals as it enables them to perform spectrum analysis, deepening insight and enriching service delivery.

However good AI-powered tools such as ChatGPT turn out to be, they are amplifications – not substitutes – for human judgment. They have a place in the financial decision-making process but do not fill this role.

When used judiciously, ChatGPT can help increase productivity and innovation without negating the human input and judgment essential to finance.

Therefore, AI tools in finance will almost certainly become more indispensable as technology advances.

Adopting ChatGPT in finance can mean conducting business more efficiently and fundamentally altering how financial institutions relate to data, their clients, and each other.

If you want to learn more about artificial intelligence in finance, request a Datarails demo today.