If you work in finance, you probably live and breathe numbers. But here’s the thing: numbers alone don’t drive decisions. What really makes an impact? Data storytelling.

Data storytelling transforms financial data into actionable insights.

For Financial Planning & Analysis (FP&A), data storytelling is what brings data to life and helps drive decision-making.

Data storytelling explains business results, trends, and forecasts in a way that informs stakeholders. It turns complex financial results into easy-to-understand information. It gives it the human touch.

This is important because the most sophisticated analysis means nothing if no one understands it.

Yet, too many FP&A professionals struggle to transform financial data into practical solutions.

FP&A Storytelling: A How-To Guide

This article walks you through overcoming common challenges and transforms raw financial data into actionable insights through effective storytelling.

Understanding Your Audience

The first rule of data storytelling in finance is knowing your audience. Most stakeholders do not have a financial background, so tailoring your message to their needs is vital.

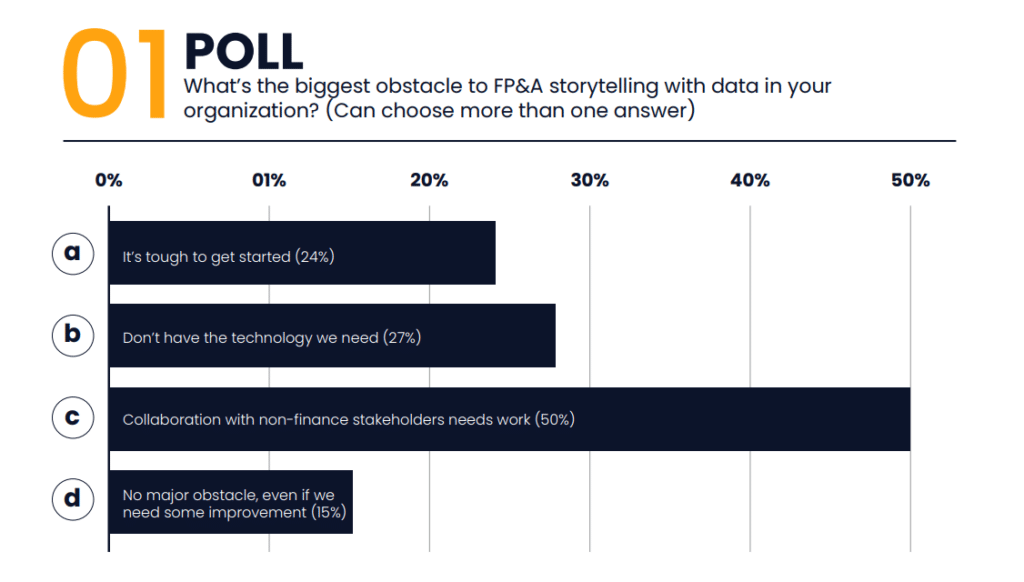

In fact, in a Datarails webinar poll asking “What’s the biggest obstacle to FP&A storytelling with data in your organization?” collaboration with non-finance stakeholders was the most mentioned obstacle by a large margin.

Common finance terms or acronyms require a brief explanation for those not steeped in financial jargon.

If you’re presenting to a technically-minded CFO, you might dive into the details, but if you’re in front of a broad audience (like an all-hands meeting or an earnings call), you’ll need to distill critical concepts into plain language.

For example, your company’s sales manager might care most about how the numbers relate to sales targets or customer acquisition costs. In contrast, the CEO and Board of Directors will be focused on high-level trends, growth, and risks.

When you consider what your audience needs from your data (understanding how different roles care about different things), you’ll begin to understand your audience. The level of detail you provide will depend on the audience’s financial sophistication.

Preparing layered information is helpful in this endeavor: present a concise summary for everyone and have detailed backup slides or an appendix ready for those who want to dive deeper.

That way, you keep things relevant and digestible for most listeners but can address in-depth questions from the savvy few.

Lastly, put yourself in your audience’s shoes. By empathizing with your audience’s perspective, you can frame your data in a context that matters to them.

How Do You Structure a Finance Story?

Every great financial presentation tells a compelling story.

To build a persuasive narrative, focus on three essential elements: Who, how, and what.

Start by clarifying who the story is about (and for)—tying it back to understanding your audience. Is this story meant for the executive team, the sales department, the board, or the entire organization? The “who” will determine the tone, depth, and language used.

Now, it’s time to decide on a communication method. This includes the format (slides, memo, live demo), the structure of your storyline, and the visuals or analogies you might use to make it engaging.

Finally, pin down what main point you need to convey—the core insight or call-to-action you want your audience to take away.

Context is the secret sauce that makes your data meaningful. After all, numbers never speak for themselves—you need to provide the background and comparisons that give them significance.

Data is meaningless without context, and providing that extra information answers the audience’s unspoken questions: “Is this good or bad? Compared to what?”. Context turns raw data into insight.

It also helps pre-empt questions and biases. If you’ve thought about what questions the audience might ask (“Why is this number up/down?”), you can weave those explanations into your story proactively.

What Makes Financial Data Visualization So Powerful?

A picture is worth a thousand words – especially in finance, where a well-chosen chart can highlight insights that pages of numbers may not.

Financial data visualization is the cornerstone of effective FP&A storytelling. Research shows that people process visuals dramatically faster than text and retain the information longer.

A simple chart or graph can instantly spotlight a trend or comparison—something that may take several sentences and still not be clear.

The trick is choosing the right visual type for the data and the message you want to deliver.

Here are a few examples:

- Showing a trend over time: A line chart is probably your best bet.

- Comparing parts of a whole or different categories: A bar chart (or column chart) makes comparisons obvious

- Displaying a distribution or relationship: A scatterplot or heatmap might be appropriate

Don’t default to overly complex or novel chart types when a simple one does the job—clarity eclipses flashiness.

How Do You Make FP&A Storytelling More Engaging?

Delivering the story is as important as building it. You could have the perfect analysis and captivating visuals, but if the presentation is dry or misaligned with your audience, the insights may not stick.

Here are some strategies to actively engage your audience and elevate your data storytelling:

1) Ask (and Answer) the Right Questions

Great FP&A storytelling often starts by addressing the questions that matter most to stakeholders.

As you plan your presentation, think about the questions your audience is likely to ask and structure your story around answering them.

For example: “Are we on schedule with our targets? If not, why? What should we do about it?”

Framing your narrative around these concerns keeps the audience invested—demonstrating that you understand their priorities.

2) Show, Don’t Tell

Whenever possible, opt for visuals or demonstrations over text-heavy monologues.

Humans have short attention spans, and nothing disengages an audience faster than reading off a wall of text or an endless spreadsheet.

Instead of saying, “Department X had a 5% uptick and department Y had a 2% uptick with department Z flat,” put up a simple bar chart that shows the comparison.

Walk the audience through the insight (“X is leading, Y is modestly up, Z is flat – so we might shift resources from Z to X and Y”). This keeps the focus on insights, not just reciting numbers.

In a live presentation, you want your audience to listen to you, not read slides. Bullet points, short phrases, and visual highlights (like an arrow pointing to a critical number) can help keep the focus on your narrative.

3) Make It a Two-Way Conversation

Engagement peaks when your audience feels involved rather than talked at. Encourage questions during or (at least) after your presentation.

Watch for non-verbal cues while you present: are people nodding along, or do they look confused/bored? If you notice blank stares or frowns, it might be a sign you’re moving too fast or using jargon.

Take a moment to reiterate the fundamental point in simpler terms or draw attention back to a visual aid. Be sure to pause regularly to check if your audience has any questions.

4) Practice and Polish Your Delivery

As FP&A storytelling merges into public speaking, it pays to practice your presentation skills.

Run through your presentation multiple times—not to memorize a script but to get comfortable with the flow and timing.

Practicing out loud also helps you iron out awkward phrasing and gives you a sense of which parts might need a better transition or explanation.

Don’t overlook body language and voice either: standing (or sitting) with good posture, making eye contact, and using a confident, clear voice will command attention.

Key Takeaways

Becoming a compelling data storyteller in finance doesn’t happen overnight, but you can steadily improve with conscious practice.

- Start by always keeping your audience in mind—tailor your message to their level and interests, and speak their language (minimize unnecessary financial jargon).

- Focus your narrative around a clear purpose or key question—provide context so every number carries meaning.

- The liberal use of visuals helps simplify complex data, remembering that clarity and simplicity in charts will beat complexity every time.

- Most of your slides or visuals should communicate one main insight—trim the excess.

- Over time, you’ll also develop an intuition for storytelling structure: setting up the problem, delivering the insight, and ending with a call to action or recommendation.

- Finally, try to practice the art of storytelling whenever you can.

Modern FP&A software solutions (such as Datarails) automate the heavy lifting of data consolidation and reporting, freeing you to spend more time on analysis and story-crafting.

Data visualization tools or Excel add-ins help create cleaner charts with ease, and presentation tools add interactivity to keep audiences engaged.

Leverage these tools and resources to enhance your capabilities—just remember that tools complement your story, it does not replace the need for a human narrative touch.

By applying the principles in this guide—understanding your audience, crafting a focused narrative, visualizing effectively, and engaging with confidence—you’ll be well on your way to turning financial data into impactful insights that resonate with any audience.