- 23% of CFO posts mention AI skills

- “Soft Skills” increasing, but only 14% of finance jobs offer remote working

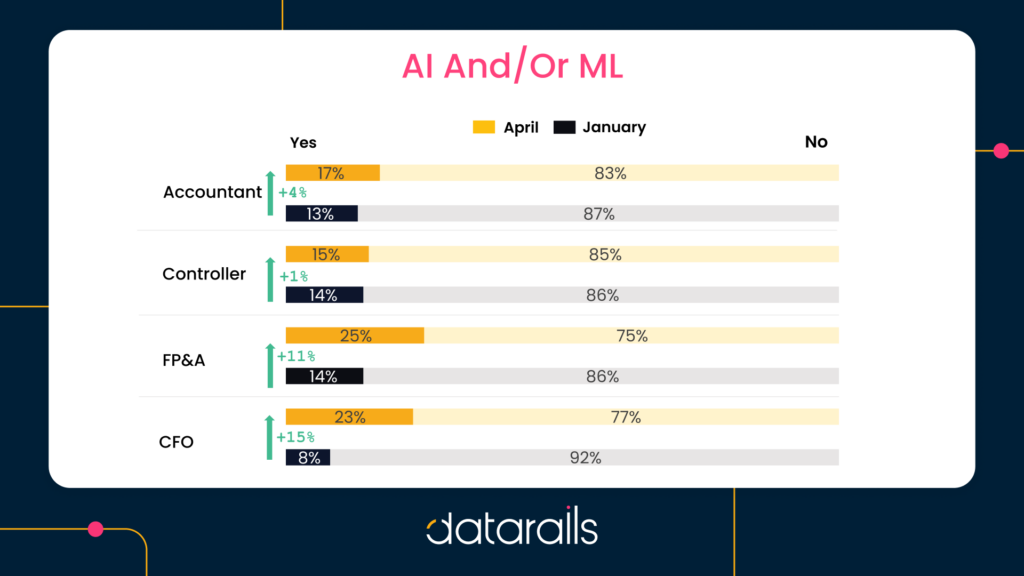

The number of US chief financial officer roles requiring knowledge of artificial intelligence has risen by 15% during the first quarter of 2024, an analysis of 2000 open job posts reveals. By April 2024, 23% of job listings mentioned CFOs requiring familiarity with AI.

The findings come from Financial Planning and Analysis solution (FP&A) Datarails, the AI-powered Financial Planning and Analysis platform for Excel users. The study analyzed 2,000 job listings for CFOs, FP&A professionals, Controllers, and Senior Accountants in January and April 2024.

The research examined job listings from major US companies including HSB, Prudential, Royal Caribbean Group, and Honeywell, on Glassdoor, Indeed, Job2Careers, and ZipRecruiter.

CFOs saw the highest increase in mentions of AI skills (15%) with nearly one quarter (23%) of US CFO jobs requiring AI expertise or knowledge by April 2024. In second-place, FP&A roles saw a 9% rise in mentions of AI in this period (25% of all FP&A roles). Accountants saw a 4% rise in this period (with AI mentioned in 17% of all accountant roles by April 2024), and controllers (only a 1% increase, and 15% of all controller jobs).

For instance, House of Sillage required a CFO “adept at leveraging technology and AI to drive growth and efficiency, with experience in firm acquisitions and predictive analytics”. A listing for a New York based series C-Startup is hunting for a CFO “passionate about harnessing the power of AI to solve complex challenges”. A post for Division CFO at Crossover requires “using your financial systems expertise to simplify complex tasks and infuse AI-driven insights into day-to-day operations”. And to be the CFO of FD Capital requires familiarity with “Web3 and AI technologies.”

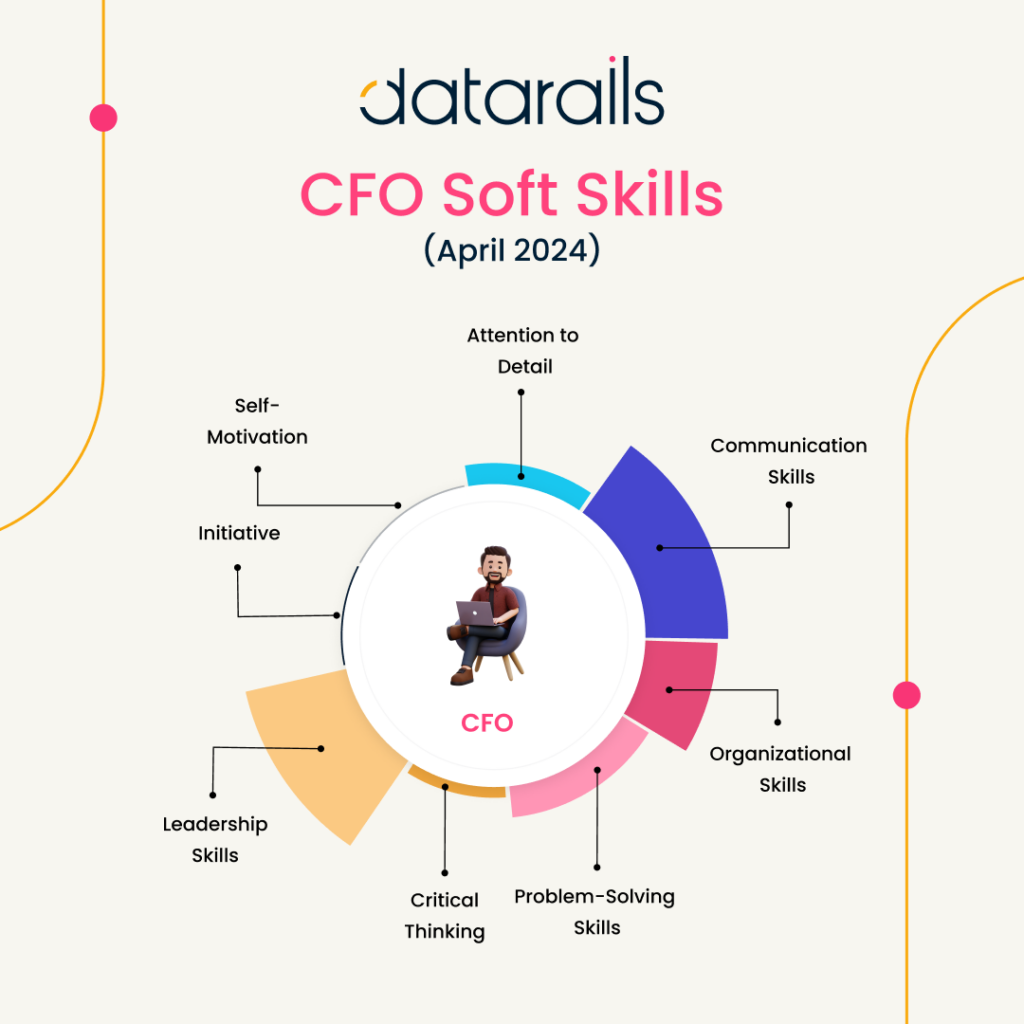

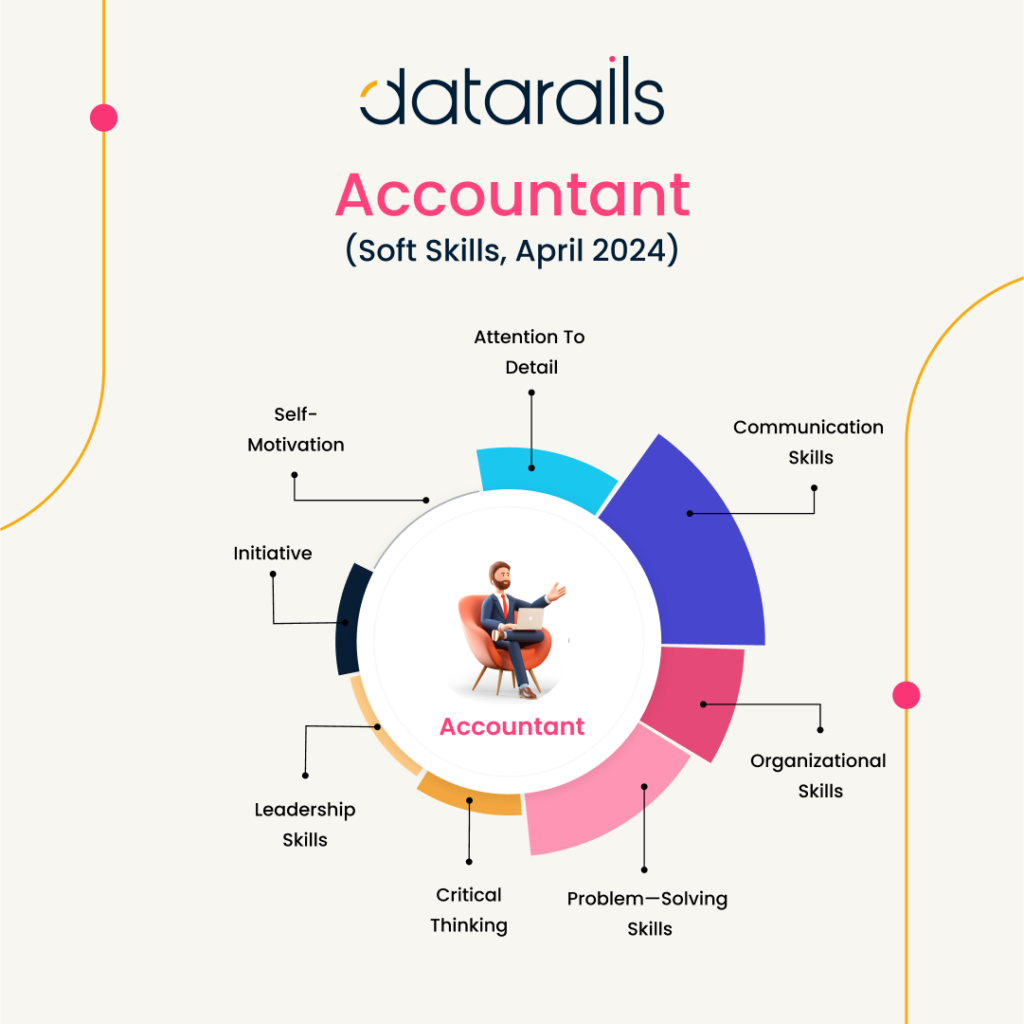

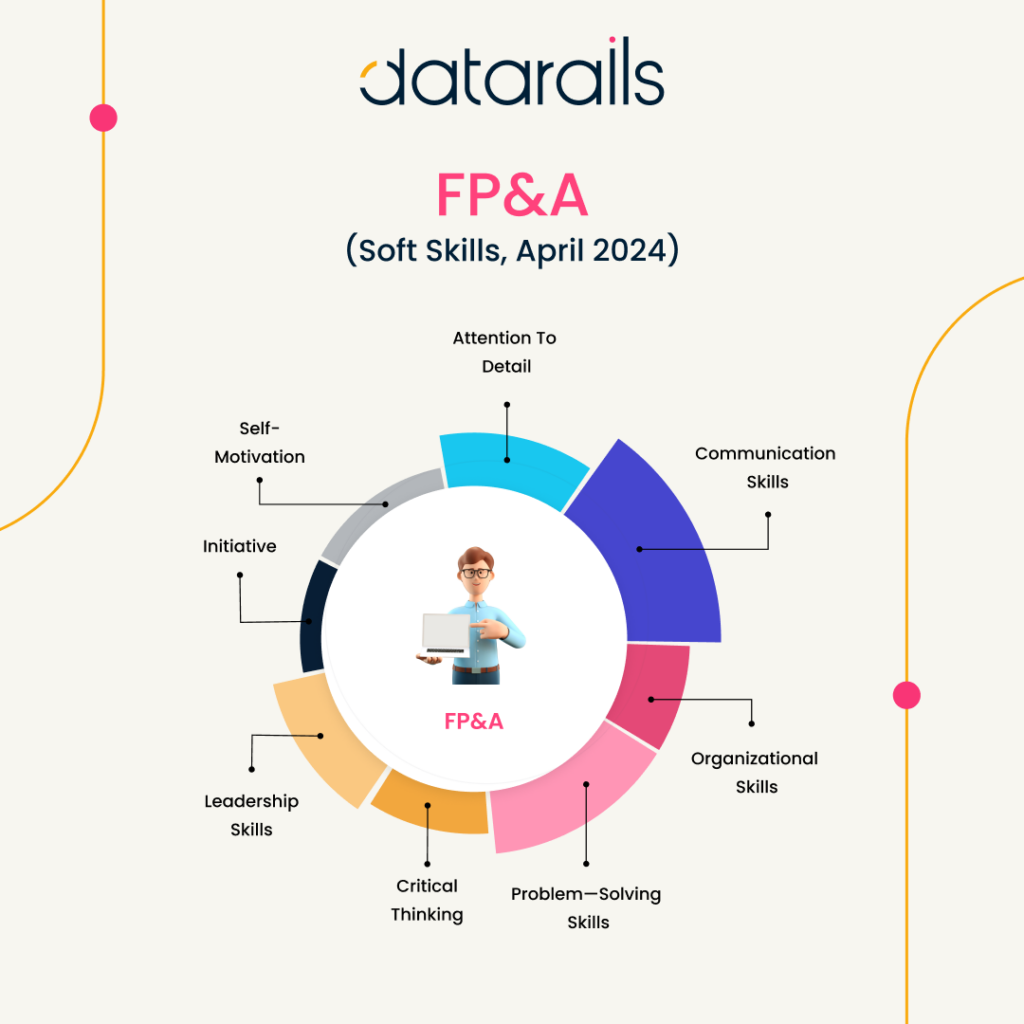

Soft Skills Rising by 5% in Finance teams

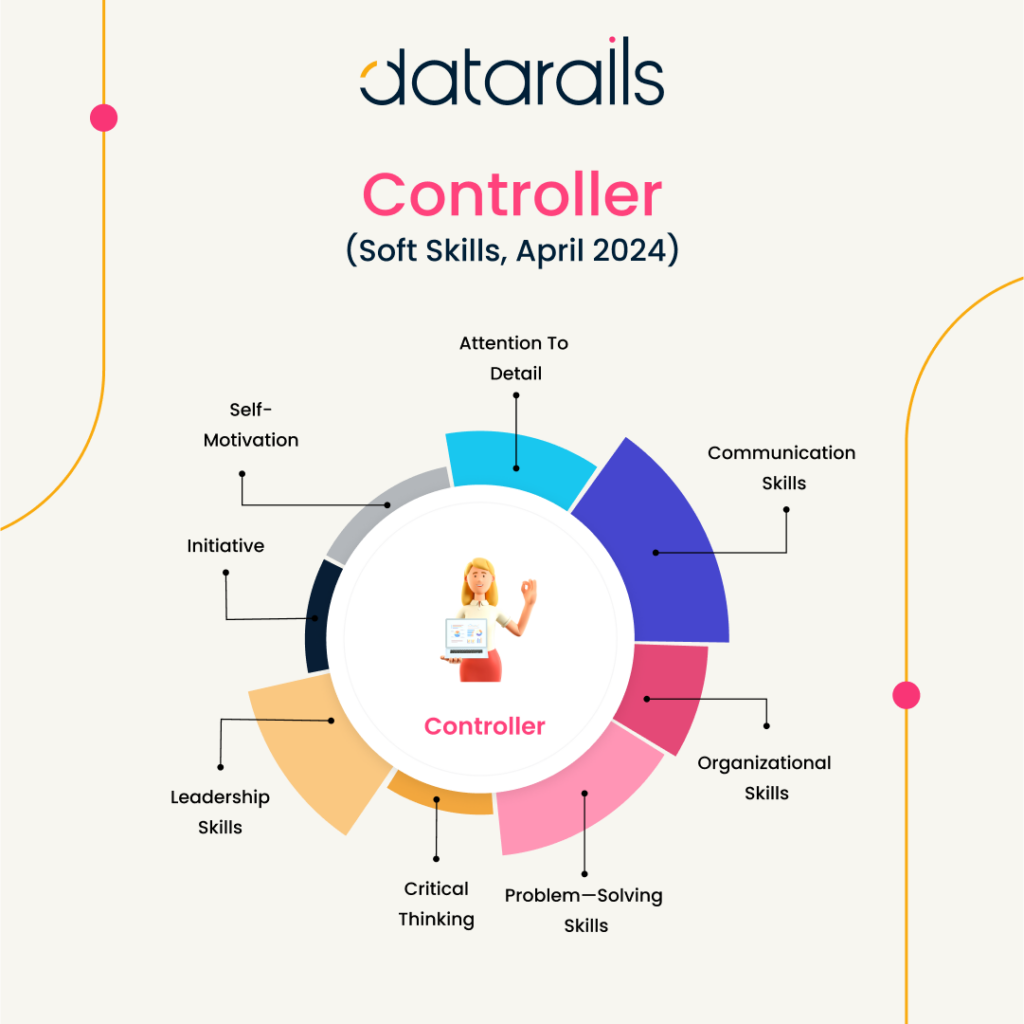

“Soft skills”–traits less able to be replicated by AI–saw a 5% increase in mentions across job posts in the CFO’s Office in 2024. Of these soft skills, “attention to detail” rose fastest for chief financial officer roles (18.7%). This comes at a time when “trusting and verifying” AI outputs is vital within finance. For accountants, “problem solving” is the fastest rising soft skill (15% increase) while “self motivation” is fastest rising m (13.3% increase) in controller job postings. .

Remote work only offered in 14% of jobs in CFO’s Office

By contrast, the continuing decline of remote work opportunities was felt over the first four months of 2024, dropping from 19% of all finance positions in January to only 14% by April. The accountant position saw remote work opportunities rise by 6% (to 23% of vacancies) followed by controllers (22% of positions were work from home). FP&A roles saw a drop of 5% in remote work opportunities (to 19% of vacancies). Prominent organizations offering remote work for their finance team included Hennepin Healthcare, Volvo, Allstate. AECOM, and Harvard University.

64% of CFO roles require a Master’s Degree or MBA

The picture of higher education requirements reveals that for CFOs 64% of open vacancies require a master’s degree or an MBA. This is followed by the FP&A position where 42% of open roles require this, followed by controllers (41%) and accountants (19%). Across the finance team 38% of vacancies list the need for a CPA.

Excel still thriving in CFO’s Office

Overall, 60% of all roles in the CFO’s Office required mastery of software such as NetSuite, SAP, Oracle, and Tableau. Despite assertions that Excel may be replaced–as automation and AI continues apace– Excel skills are explicitly mentioned in 30% of all CFO’s Office roles by April 2023. Excel requirements are most common in FP&A vacancies (rising to 66% of all FP&A roles by April 2024). For accountants 36% of roles cited Excel skills, and for Controllers 24% did. By contrast, only 17% of CFO job listings state the need for Excel skills.

Didi Gurfinkel, Co-Founder and CEO of Datarails, said: “The rapid evolution of the CFO’s Office, underscores the critical role that AI and digital transformation play in modern finance. CFOs and their teams must not only understand the operational benefits of AI but also its strategic implications for business models and decision-making. As the finance landscape continues to shift at an unprecedented pace, those who adapt and embrace these changes will be best positioned to advance their careers and drive strategic growth.”

About Datarails

Datarails is the AI-powered Financial Planning and Analysis platform for Excel users.

Datarails allows finance teams to continue to reap all the benefits you love from Excel, while bringing data consolidation, advanced visualization, reporting and AI capabilities to uncover strategic business insights.