I’ve spent the better part of a decade as a fractional CFO, jumping between spreadsheet tabs like hot coals. My relationship with Excel could be described as “complicated”—necessary but painful. Sort of like dental work or family reunions.

After test-driving more FP&A solutions than I’d like to admit, I stumbled upon Datarails. Not with a grand revelation, mind you – more like the suspicious relief when you realize the weird noise your car was making has mysteriously disappeared.

If you’ve ever found yourself at 11 PM reconciling numbers that should match but don’t, dealing with version control nightmares, or explaining to your CEO why last month’s report looks nothing like this month’s – pull up a chair. We’re battle brothers in spreadsheet purgatory.

I’m not here to sell you snake oil. Instead, I want to give you the straight talk on how Datarails helped me reclaim my weekends and my sanity—and why it might just be the FP&A solution that breaks your dysfunctional relationship with manual financial planning, too.

My Favorite Features

I bounce between client ecosystems like a human basketball and have naturally developed strong opinions about financial tools. Datarails has many great features, but a few stand out most as my personal favorites.

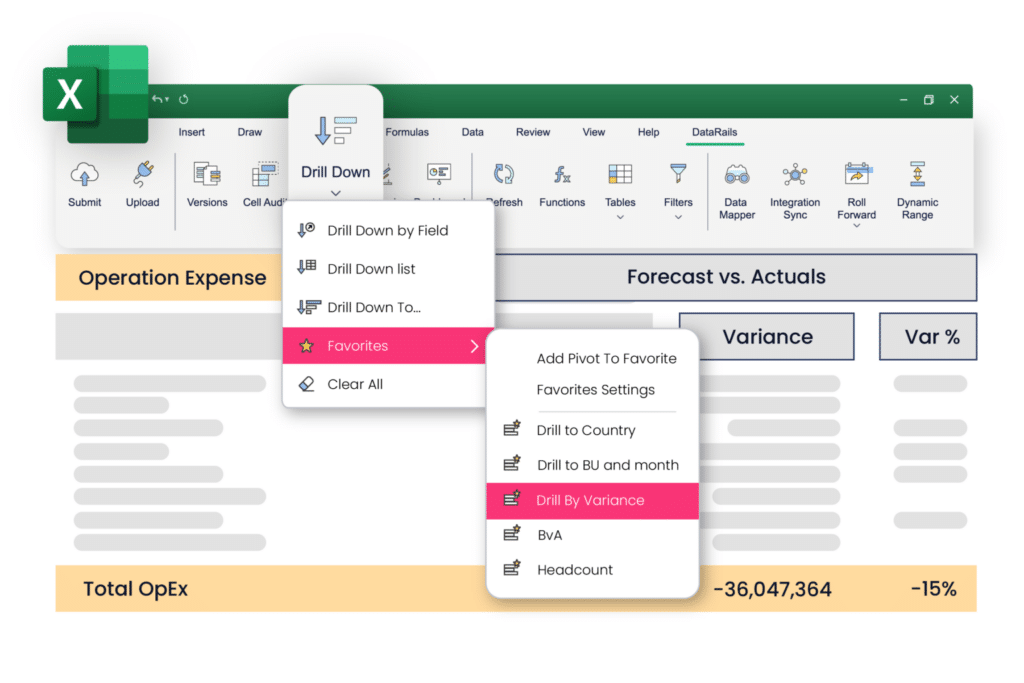

1. Excel Integration That Doesn’t Force You to Abandon Ship

The financial world is divided into two camps: those who hate Excel and those who admit they need it anyway. Datarails smartly plays to the second group.

What makes this my favorite feature is simple—I don’t have to retrain myself or my clients on yet another platform with its own quirks and limitations. My carefully crafted models still work exactly as designed, but without the manual data-wrangling that used to consume my Sundays.

When moving between vastly different client environments—from bootstrapped startups to established firms—this compatibility means I spend time analyzing numbers, not rebuilding systems from scratch every time I walk through a new door (in-person and virtual).

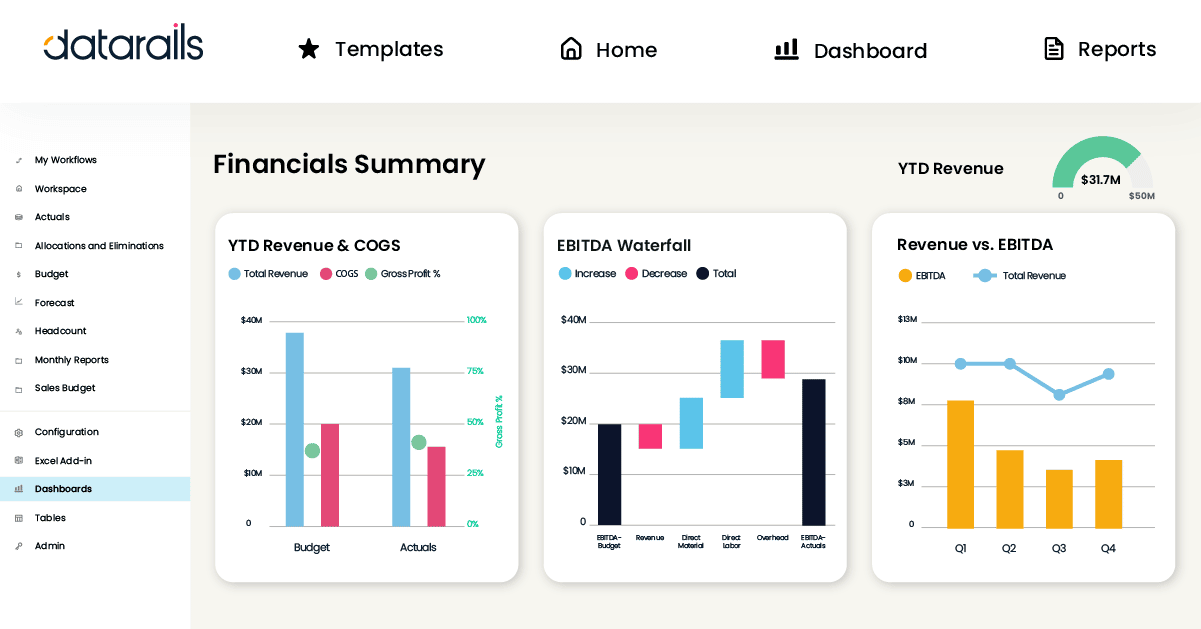

2. Real-Time Dashboards That End the “Is This Current?” Question

The text message that once filled me with dread: “Hey, can you send the latest numbers before our investor call in 30 minutes?”

Now, my clients access live financial data whenever they need it. The constant back-and-forth of report requests has all but disappeared from my inbox, replaced by more substantive strategic questions. My value now comes from interpreting data, not merely compiling it.

The unexpected benefit? Clients see me less as a numbers mechanic and more as the strategic advisor I always aimed to be. That alone justifies the subscription cost.

3. AI Insights That Actually Earn Their Keep

Most “AI-powered” financial tools I’ve encountered seem designed by optimists who’ve never stared down a surprise audit or explained unexpected variance to skeptical investors.

And until Datarails came along, I missed things—important things, occasionally. I’m human, after all, and have multiple clients and only one brain.

What sets Datarails apart is how its analytical capabilities adapt to the unique financial stories of each client and identify patterns specific to each business model without requiring endless customization on my part. Having this automated second set of eyes provides both confidence and efficiency—like having an assistant who never asks for vacation time.

4. Security That Doesn’t Feel Like Financial Prison

My clients range from “password is ‘password'” to “military-grade encryption for the coffee budget.” Datarails handles both extremes.

With single-source truth and automatic version control, everyone stays on the same financial page. Permissions are granular enough that the sales team sees revenue targets without accessing compensation details.

The real breakthrough? I no longer wake up in cold sweats, wondering if someone downloaded the wrong file or if a critical formula got accidentally deleted. My weekends are mine again, and my clients trust that their financial infrastructure isn’t built on digital quicksand.

Differences from Other FP&A Software

I’m a survivor of countless financial platform demos that felt longer than tax season. So I know a thing or two about what works and what doesn’t. In my view, here’s what sets Datarails apart from others:

- Excel Stays, Manual Work Goes: Other platforms force you to choose: keep Excel OR get automation. Datarails gives you both. Keep your models and formulas while ditching the weekend data-entry sessions. No other platform does this without compromise.

- Up and Running in Days, Not Months: Most implementations drag on forever. Datarails takes about a week. While competitors are still scheduling kickoff meetings, you’ll be running reports, a fundamentally different approach to deployment.

- Grows Without Breaking: When you expand to new regions or add entities, competitors often require system rebuilds. Datarails scales through simple configuration. Your system evolves alongside your business without the “rip and replace” drama other platforms require.

- Connects to Everything Automatically: Other tools need manual data uploads or expensive connectors. Datarails pulls out of the box from ERPs, CRMs, and accounting systems. No more copying numbers between systems or explaining why different departments have different figures.

- Ends the Number Wars: With one financial source of truth, the “my spreadsheet says something different” arguments disappear. Unlike other platforms that fragment data or force rigid standardization, Datarails creates consistency without sacrificing departmental workflows.

Where It Saves Me Time

My life as a fractional CFO once resembled a digital hamster wheel—racing between multiple client systems, drowning in spreadsheets, and sacrificing sleep to the gods of month-end close. Manual data gathering from QuickBooks, ERPs, and those infamous “final_FINAL_v7” Excel files didn’t just eat my time—it feasted on it like a financial vampire. Then, Datarails walked in and changed everything.

Goodbye Data Drudgery, Hello 75% Time Savings

Datarails cut my data consolidation time by about 75%. Let that sink in—I’ve reclaimed three-quarters of what used to be spreadsheet purgatory. The platform sucks data from multiple sources into one system faster than I can say “reconciliation nightmare.”

Month-end close used to hold me hostage for five days straight. Five. Full. Days. Now? I wrap it up in a few hours and still have time for lunch. The platform grabs data from accounting software, ERPs, and CRM systems while I sip coffee instead of frantically copying numbers until my Ctrl+V key begs for mercy.

The real magic happens with real-time updates. Numbers change in one place, they change everywhere—automatically. No more playing financial detective, hunting down discrepancies across 27 identical-looking spreadsheets. The system flags inconsistencies before they become board-meeting embarrassments, saving both my time and reputation.

Financial Storytelling Without the Sweat

Financial presentations once held the dubious honor of “most soul-crushing task” on my to-do list. I’d manually transplant numbers into slides, craft variance explanations from scratch, and pray nothing changed before the meeting.

Datarails’ Storyboards now conjure professional presentations at warp speed. The AI builds narrative commentary explaining why revenue dipped or expenses spiked and saves me from hours of financial storytelling gymnastics.

The beauty lies in consistency—when numbers update, the commentary follows suit. No more presentations where slide 7 contradicts slide 12 because I forgot to update both after a last-minute change. The platform creates presentations with all data pulled from a single source of truth and eliminates those stomach-dropping moments when an executive points out conflicting figures.

Email Archeology: A Defunct Profession

My inbox used to resemble a digital artifact collection—layers upon layers of spreadsheet versions sent with increasingly desperate subject lines. Collaboration meant excavating through this mess while different departments insisted their numbers were the correct ones.

Datarails banished the chaos with real-time collaboration tools that made version conflicts obsolete, like floppy disks. All stakeholders now operate in one centralized platform where numbers update in real time—no archaeological degree required.

Budget discussions transformed from number-validation exercises into actual strategic conversations. The days of wasting the first 20 minutes of every meeting determining which spreadsheet version we should be looking at are history. Now we get right into what the numbers mean, not whether they’re correct.

Stakeholders’ Favorite Features

You wouldn’t believe the reactions I get when clients discover what Datarails can do. I’ve sat through countless “aha!” moments that transform financial headaches into actual wins for everyone involved.

- The “Where Has This Been All My Life?” Dashboards: My C-suite clients actually get excited about financial data now. They’ve tossed those outdated reports and instead make informed decisions backed by numbers they can pull up instantly. No more texting the finance team at midnight before board meetings. The strategic edge of having current financials at their fingertips turns even the most data-averse executives into DataRails fans.

- The “I Might Leave Work On Time” Toolkit: Finance teams cheer when they see how DataRails crushes their month-end chaos. That version control feature? Pure magic for teams tired of spreadsheet detective work. The collaborative tools have turned finance departments from stressed-out number crunchers into cohesive teams who can focus on analysis instead of hunting down formula errors.

- The “Finance Doesn’t Make Me Sweat” Experience: Department managers who once avoided financial conversations now check their custom dashboards daily. They’ve ditched the awkward “Can you explain this again?” emails and grabbed exactly what they needed themselves. Budget ownership has skyrocketed, with managers controlling spending based on accurate data instead of vague estimates. Financial transparency has even ended those heated “who spent what?” debates.

The Bottom Line: Why My Finance Life Now Has Fewer Fire Drills

Datarails is like that friend who speaks both Excel and Enterprise—fluently and without the ego. It brilliantly bridges the gap between spreadsheet comfort and financial powerhouse and saves my clients from the dreaded “we need both” dilemma.

I’ve built my business on delivering results, not excuses—and Datarails has become my secret weapon. When clients discover they can keep their beloved spreadsheets while gaining insights that previously required selling a kidney to afford enterprise systems, they look at me like I’ve performed a financial miracle.

Want the unfiltered truth? Take Datarails for a spin yourself.

Nothing beats watching financial chaos transform into strategic gold before your eyes. Your stakeholders will wonder what you’re putting in your coffee, your calendar might suddenly show these mythical things called “weekends,” and your financial insights will finally arrive before they qualify for retirement benefits.