Balance Sheet Template

Download Free Template

This free download balance sheet template will allow you to create one of the major financial statements that every business should have – the balance sheet report.

Whether your company is a start-up or has been operating for many years, the balance sheet provides a clear picture of the financial position for your business in a given period.

Datarails’ Balance Sheet Template

This balance sheet template in excel has been created to help your business record a balance sheet statement. It is a simple and effective tool for any company to showcase its financial strength to external investors or to use as a tool for financial planning.

Steps to Fill in the Balance Sheet Template

1. Identify and record your current assets

Fill in the values of the assets your company owns such as:

Cash and cash equivalents: This includes any cash in the bank or at hand, short-term and easily convertible investments such as marketable securities, treasury bills, commercial papers, and certificate of deposits.

Accounts receivable: When customers purchase your goods and/or services with the option to pay later, this results in a current asset known as accounts receivable.

Inventory: Most businesses own inventory, however, manufacturing and production companies particularly carry more inventory to aid frequent goods production. A company’s inventory may include raw materials, work-in-progress (semi-finished goods) or final products yet to be sold.

Prepaid expenses: When you pay for expenses ahead of the time they are incurred, this results in non-current assets known as prepaid expenses. A common example may be rent expenses that have already been paid for future months.

2. Identify and record your non-current assets

This would generally include the value of assets such as:

Property and equipment: In this section, record the value of any building or land that your company owns or has leased. Input the cost of machinery or other fixed assets.

Other fixed assets: Include any other assets that are held for more than a year or are capital-intensive investments.

Non-tangible assets: If applicable, non-tangible assets such as goodwill, patents, or other intellectual property can be recorded.

Generally, because non-current assets are held for a long period, they are depreciated or amortized over time and the net book value (NBV) is reported. The NBV is the difference between the original cost of the asset and the accumulated depreciation as at the period the balance sheet is created.

3. Identify and record your current liabilities

Report all that your company owes and is expected to pay back within a short period, usually a year. This will include items such as:

Accounts payable: When you purchase goods or services from vendors with the option to pay later, you end up with a liability called accounts payable. This will be recorded under your current liabilities.

Accrued expenses: Expenses that are paid in arrears after the costs have been incurred result in accrued expenses.

Unearned revenue: If your customers make prepayments, you will record this as unearned revenue. This is a common liability that arises in a contract accounting process that has recognized payments for a service that has not yet been performed for the customer.

Other current liabilities you can record are interest payable, wages owed, dividends payable, taxes payable, portions of a long-term debt that is payable within a year, etc.

4. Identify and record your non-current liabilities

Long-term debt: These are usually loans gotten from banks or other lenders. It can also include corporate bonds that are sold to individuals in exchange for periodic interest payments until the principal has been fully paid back.

Other non-current liabilities you can record for your company include lease liabilities for assets that have been leased.

5. Record the shareholder equity in your company.

Equity Capital: This represents the ownership of a company. The owner’s capital investments in the business or shares bought by external investors are recorded here.

Retained Earnings: If the net income less any dividends have been reinvested into the company, this can be recorded as retained earnings. Retained earnings are simply undistributed net earnings of the business.

6. Check for accuracies or errors.

The sum of your company’s current assets and non-current assets make up the total assets while the sum of the current liabilities and non-current liabilities make up the total liabilities. Using the balance sheet equation, the check shows that the total assets should equal the sum of the total liabilities and shareholder equity.

How to Fill in the Balance Sheet Template

An example:

Company A services automobiles and sells spare parts. The company’s bookkeeper has recorded the financial transactions for 2021 and wants to prepare a balance sheet report for 2021.

The bookkeeper has identified and recorded the following assets, liabilities, and shareholder’s equity for the year-end as shown below:

| Items | Classification | Amount |

| Money in the bank | Cash | $ 1,000,000 |

| Invoices not yet paid by customers | Accounts Receivable | $ 5,000,000 |

| Services paid for in advance | Prepaid Expenses | $ 200,000 |

| Spare parts and tools | Inventory | $ 1,000,000 |

| Machinery | Property & Equipment | $ 2,000,000 |

| Invoices from suppliers not yet paid | Accounts Payable | $ 2,500,000 |

| Services from vendors not yet paid | Accrued expenses | $ 500,000 |

| Payments made by customers for services not yet fulfilled | Unearned revenue | $ 300,000 |

| A 5-year loan from the bank | Long-term debt | $ 3,000,000 |

| Equipment lease | Other long-term liabilities | $ 1,000,000 |

| Shares owned in the company | Equity Capital | $ 1,000,000 |

| Earnings reinvested into the company | Retained Earnings | $ 900,000 |

The bookkeeper will perform the following steps to complete the balance sheet template:

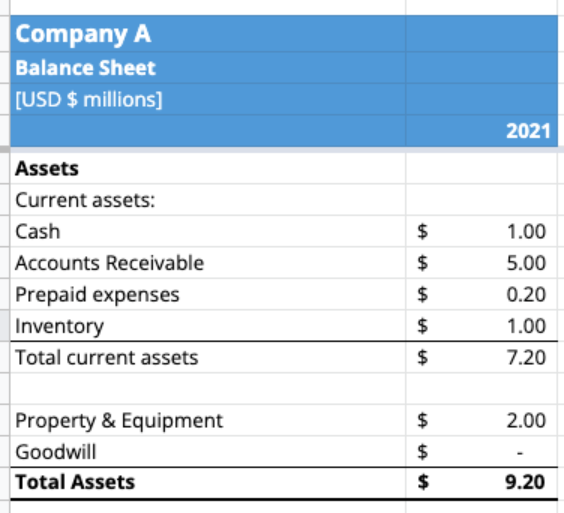

1. Fill in the assets and noncurrent assets into the balance sheet as shown below:

Total assets for 2021 is $9,200,000.

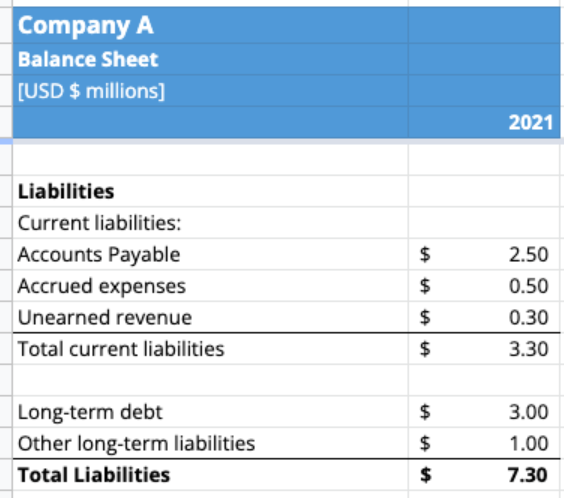

2. Next, the liabilities section will be filled in as shown below:

Total liabilities for 2021 is $7,300,000.

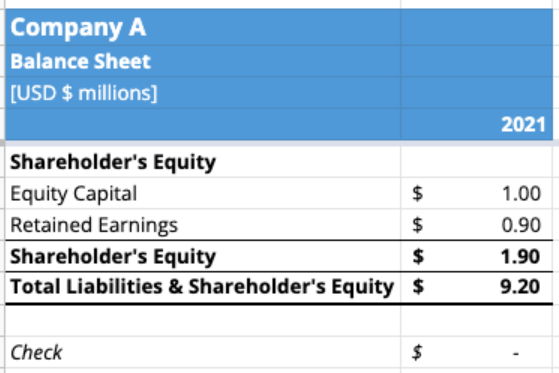

3. Next, the shareholder equity section will be filled in as shown below:

The Shareholder’s Equity for 2021 is $1,900,000.

To ensure that the balance sheet is accurate, a final check is done to show that the Total Assets are equal to the sum of the Total Liabilities and the Shareholder’s Equity.

Total Assets: $9,200,000

Total Liabilities: $7,300,000

Shareholder’s Equity: $1,900,000

Using the balance sheet equation, the check shows that Total Assets ($9,200,000) = Total Liabilities ($7,300,000) + Shareholder’s Equity ($1,900,000).

The balance sheet for Company A is now complete and ready to use.