Financial forecasting software helps finance teams collect, analyze, and predict data which allows them to make the best and most up to date decisions. Financial forecasting tools come in all types of formats and prices.

Let’s take an in depth look at the best forecasting software and their overview, features, and who they are a best fit for.

What is Financial Forecasting?

Financial forecasting involves making predictions about how well a company will do financially in the short and long term. It’s a crucial part of finance and decision-making for businesses.

To do this, financial analysts collect data, look at market trends, and make forecasts. They use past performance, current numbers, market predictions, competitor data, internal factors, strategy, and execution as the basis for their predictions. Ultimately, they use this information to estimate future income, profits, expenses, and other financial numbers.

Forecasting vs. Budgeting

Forecasting and budgeting are alike because they both focus on the future, and teams use them together. However, they have some important differences:

- Budget is a plan that outlines a company’s goals and ideal future state.

- Forecasting is a prediction of income and revenue, often used to create a practical budget.

The budget sets the company’s goals, and the forecast helps estimate future performance. The forecast is then compared to the budget to measure success.

Forecasting Techniques

Four significant methods for financial forecasting include:

1) Straight-line projection

Straight-line projection, also known as linear forecasting, is a straightforward financial forecasting technique used to predict future values based on historical data trends. It assumes a constant and uniform rate of change over time, making it a simple but often effective method for making short-term predictions.

To apply this method, you calculate the average rate of change in historical data and then copy this linear trend into the future, assuming that the same rate of change will continue. While it may not capture more complex patterns in data, such as seasonality or other trends, straight-line projection provides a quick and uncomplicated way to estimate future values, making it a valuable tool in financial analysis.

2) Moving average analysis

Moving average analysis is a forecasting technique that involves calculating the average value of a set of data points over a specific period of time, typically with the aim of identifying trends or smoothing out fluctuations in the data.

This method is particularly useful for removing noise and highlighting underlying patterns in time series data, such as stock prices or sales figures. By averaging data points over a moving window of time, it provides a more stable and comprehensible representation of the data. This makes it easier to identify trends and make informed decisions about future financial outcomes – although it does take a bit more time and effort than a simple straight-line projection.

3) Basic linear regression modeling

Basic linear regression modeling is a statistical technique used in financial forecasting and data analysis to establish a relationship between two variables: a dependent variable and one or more independent variables.

In the context of financial forecasting, the basic linear regression model aims to identify and quantify the linear association between the dependent variable, typically a financial metric like sales or revenue, and one independent variable.

4) Multiple linear regression modeling

Multiple linear regression modeling is a statistical technique used in financial forecasting and data analysis. It extends the concept of simple linear regression by considering multiple independent variables or factors to predict a dependent variable.

In the context of finance, this method allows for the examination of how various factors, such as interest rates, inflation rates, and economic indicators, collectively influence and predict a financial outcome, such as stock prices or revenue.

12 Best Financial Forecasting Software Solutions

A financial forecasting tool helps you estimate how well your business will do financially in the future. It doesn’t matter which of the four forecasting methods your company uses, or even if you use more complicated data models and techniques, forecasting software makes the process easier and and less error prone.

This enables you to use your money to make the business grow, make smart financial decisions, and keep enough cash on hand. As you get better at guessing and predicting, you’ll feel more confident about making important choices.

The top forecasting software solutions have useful templates, easy-to-use interface, and historical personal and market data letting you estimate how much money you’ll make, how much you’ll profit, how much you’ll grow, and the associated risks.

Let’s go over the top 12.

1) Datarails

Datarails empowers you to streamline, evaluate, and project revenue and expenses across your organization creating forecasts for your business. In addition, Datarails’ AI chatbot FP&A Genius, helps with forecasting as it allows you to get answers to any questions or scenarios that you, or management, might have, all from trusted and historical data.

Datarails also comes with additional financial planning and analysis (FP&A) features to facilitate realistic projections.

After consolidating and validating your forecasting data, you have the flexibility to choose between customized data presentations or visual dashboards for sharing insights with stakeholders. Drill down and audit control allows each finance team to understand and control every aspect of their budget and forecast.

In addition, the Storyboards AI feature creates automatic presentations with real time data that helps management stay connected and forecast better.

2) Cloud Zero

CloudZero equips your teams with the resources and capabilities necessary to gain insights into your cloud expenses. Additionally, it offers reporting, reconciliation, and variance analysis through CloudZero Budgets.

Its code-centric method enables you to visualize the expenses associated with tagged, untagged, and untaggable resources. What sets it apart is its ability to monitor costs per specific customer, product, software feature, project, team, and other relevant metrics that matter to you.

3) Anaplan

Anaplan leverages real-time financial information obtained from both internal and external sources to provide extensive insights for planning purposes. This platform streamlines the process of organization-wide forecasting by offering a suite of tools tailored to finance, sales, marketing, supply chain, IT, and HR departments.

Anaplan seamlessly integrates budgeting and forecasting functionalities to offer insights into financial planning, spanning from modeling to operational planning. Any modification made within the platform has a ripple effect across all related areas, ensuring that all stakeholders are promptly informed about the latest developments in relation to budget and forecast progress.

Anaplan recently announced new AI features that will help with planning and forecasting, following the trend of FP&A and AI being more and more connected.

4) Vena Solutions

Vena offers a user-friendly financial planning and analysis tool that surpasses traditional spreadsheets. This cloud-based solution empowers you to centralize all your financial data, creating a singular and reliable source for planning purposes.

In addition to budgeting and fund allocation, this solution incorporates cash flow planning and tax provisioning for your entire business. Furthermore, it provides what-if scenario analyses, and financial close management, all within an intuitive Excel-like interface.

Vena as well has announced a rollout of AI features with no date announced yet of when they will go live.

For a full comparison of Datarails and Vena, including comparing their forecasting capabilities and AI features click here.

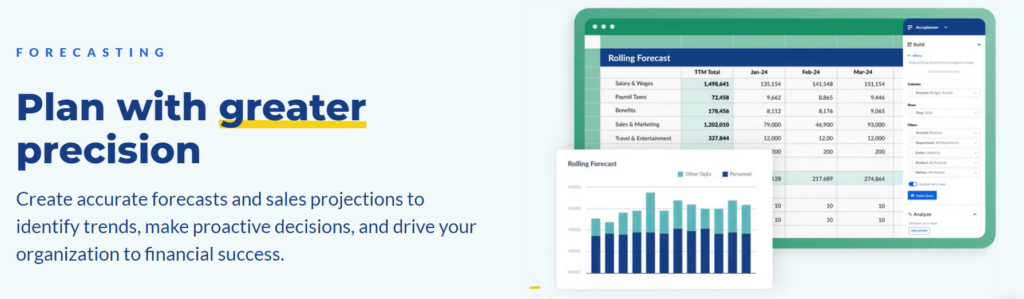

5) Cube

Cube offers comprehensive financial modeling, consolidation, and validation solutions tailored for small businesses and startups. The platform places a strong emphasis on safeguarding financial data, maintaining strict access controls through file permissions, and ensuring that templates restrict data entry to designated areas.

Using Cube’s FP&A software, you can effortlessly gather current financial data from a range of sources, including ERPs, CRMs, and HRIS systems.

Cube hasn’t announced any AI features yet, but their forecasting is simple enough to get insights as it is done in Excel or Google Sheets.

Check out our full comparison of Cube vs Datarails.

6) Oracle Essbase

In contrast to other leading forecasting tools available, Oracle’s Essbase stands out by offering financial planning and analysis capabilities designed for on-premises utilization. It boasts advanced scenario modeling, over 100 pre-designed calculation functions, and support for the multidimensional expressions (MDX) query language.

This forecasting solution is firmly rooted in the domain of enterprise financial analytics and fits mostly for very large businesses and enterprises. This foundation empowers users to create intricate hierarchical relationships with multiple levels and aggregations.

Furthermore, it allows for seamless integration with different data sources, allowing you to quickly convert spreadsheets into readily usable financial forecasting assets. Whether you are dealing with small or large-scale business structures, Essbase enables you to thoroughly test your models.

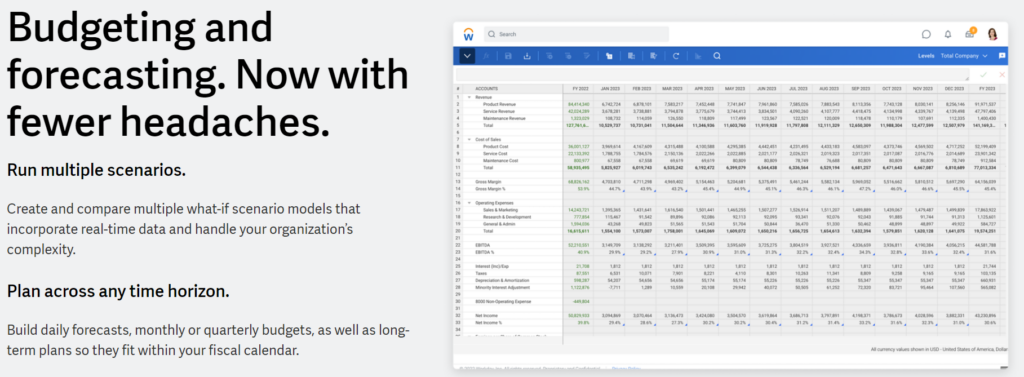

7) Workday Adaptive Planning

Adaptive Planning provides a diverse array of forecasting tools tailored to different types of businesses, their objectives, and financial hubs.

The platform seamlessly integrates budgeting and forecasting functions, encompassing a spectrum of techniques such as continuous forecasts and hypothetical scenario analysis, as well as top-down and bottom-up budgeting methods, including zero and incremental budgeting strategies.

Furthermore, it leverages real-time data and supports forecasting on a daily, monthly, quarterly, and long-term basis, while also facilitating the integration of all your financial planning tools to streamline projections. Additionally, Workday has a comprehensive HR function that helps for large enterprises who put a large emphasis on headcount.

Check out our complete comparison of Datarails and Adaptive Planning.

8) Budgyt

If you are looking for a forecasting solution that provides in-depth transactional analysis, then Budgyt does just that. This tool replaces the complexity of an Excel-like only interface with user-friendly navigation, real-time consolidation, and collaborative budgeting. Budgyt is more popular among smaller businesses, but many mid to large size businesses have it as one of their financial software tools.

Budgyt places a significant focus on cash flow and balance sheet forecasting, allowing you to control access and track changes that integrate seamlessly into the budget. Additionally, Budgyt offers the capability to refine your activity log with various filters for verifying specific insights.

9) Planful

Planful assists financial analysts in streamlining their planning processes by offering scalable and AI-powered tools for both operational and financial planning.

With Planful, you can effortlessly perform scenario analysis and generate cash flow and rolling forecasts, tasks that typically consume days or even weeks using alternative forecasting methods. In contrast, Planful makes these tasks a matter of just a few clicks.

Moreover, the platform extends its capabilities to cover HR, sales, marketing, and accounting, ensuring management of financial plans throughout the entire organization from a single, reliable source.

Utilizing pre-designed templates and financial intelligence, Planful further empowers users to automatically store, classify, and present their data based on accounting attributes.

Planful announced a host of different AI products that help with forecasting as well as many other things within their FP&A software.

10) Prophix

Prophix puts a focus on rolling forecasts which automatically helps with more accurate and up to date forecasts. This is achieved by seamlessly integrating real-time data, historical projections, carry-forward functionalities, and the ability to introduce assumptions at various levels. The result is the creation of precise forecasts that harness data from diverse origins.

This tool consolidates actual, expected, and projected data into a unified source. Afterwards, you can easily apply the most current assumptions and quickly gauge market trends without the need for manual data input or cross-referencing with external sources.

You also have the capability to update, approve, and make adjustments to forecasts using either the feature-rich Prophix web interface or the familiar Microsoft Excel interface.

11) Oracle Hyperion

This advanced forecasting solution enhances financial predictability through streamlining both operational and financial procedures. Oracle Hyperion Planning integrates planning, budgeting, and forecasting to provide comprehensive financial insights that are analytically versatile.

With this tool, you have the capability to harmonize and delve deeper into your reports to extract insights across various teams, geographical regions, business divisions, and cost centers within your extensive organization.

Furthermore, the platform is adaptable, functioning seamlessly in the Oracle Cloud, on-premises, within your local data center, or through a blend of these options.

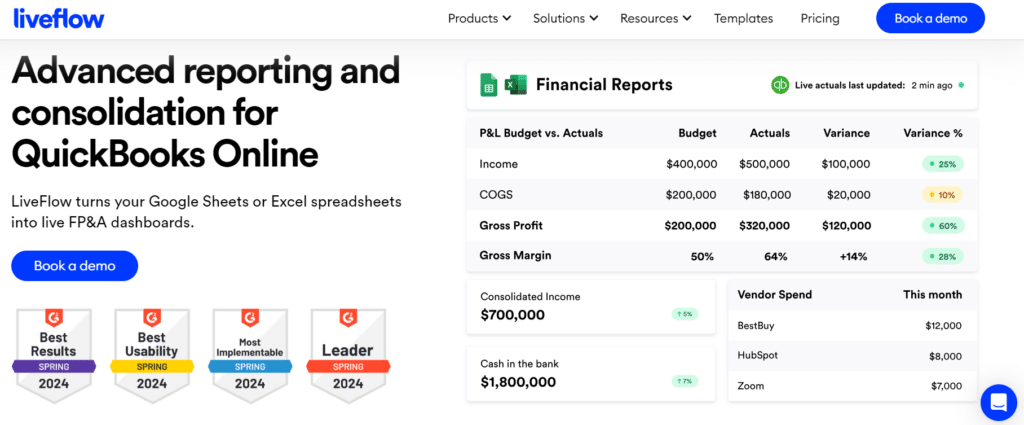

12) Liveflow

Liveflow is a simpler option than most of the others on the list, but it’s spreadsheet native, simple to use, and is built so that QuickBooks Online users can easily forecast their data.

Some of its features include live budget versus actuals from QuickBooks, live tracking of vendor spend, and turning Google Sheets or Excel spreadsheets into dashboards with drill down features.

Although you can use any type of forecasting with Liveflow, they have a useful QuickBooks 13-week cash flow template for Google Sheets as an example of their forecasting capabilities.

Conclusion

Financial forecasting is a critical aspect of decision-making for businesses. By analyzing past data, market trends, and various influencing factors, financial analysts make predictions about a company’s financial performance in the short and long term. This process helps organizations plan effectively, make informed decisions, and maintain a competitive edge in the market.

Financial software tools have become an important part of accurate and efficient financial forecasting. This enables businesses to allocate resources wisely and navigate the complexities of the financial landscape with confidence.