Financial Reporting

Automate financial reporting processes so you can focus on making data-driven decisions.

Period-end reporting with ease

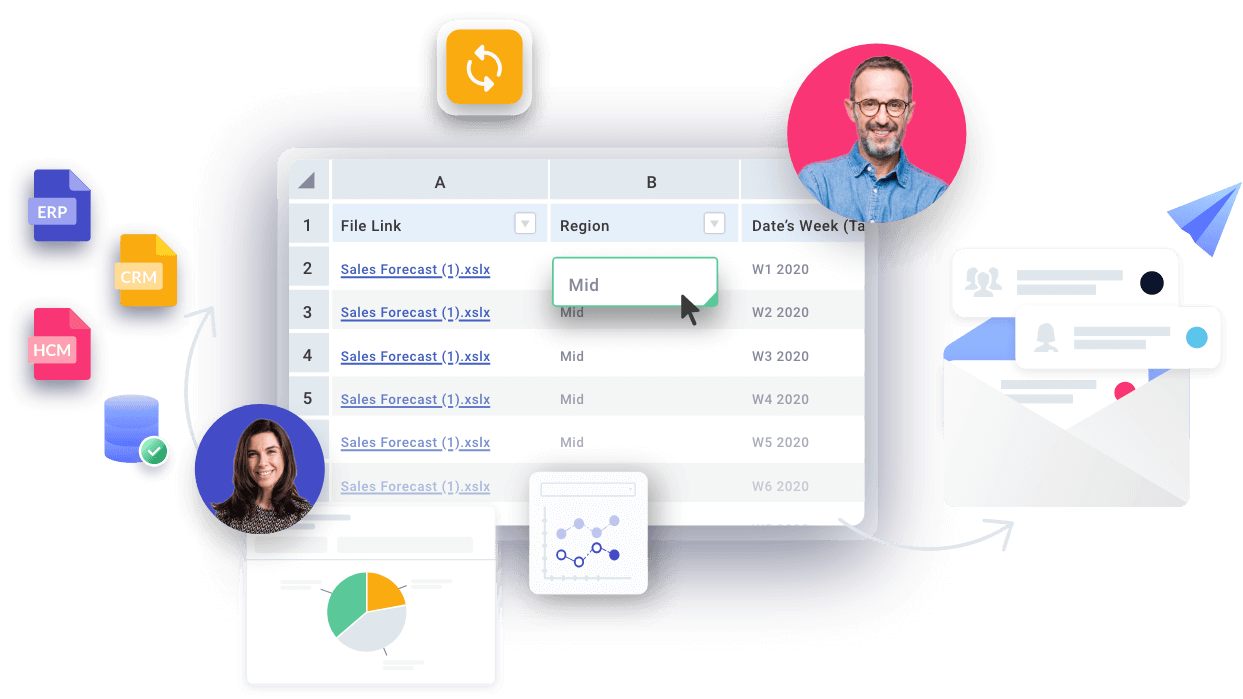

Reporting is easier when enhancing your familiar Excel spreadsheets. With Datarails, you don’t have to worry about copy/pasting information or managing VLOOKUPs.

Automatically and seamlessly populate your monthly data and export it to the balance sheet, income statement, cash flows and any other financials that you have.

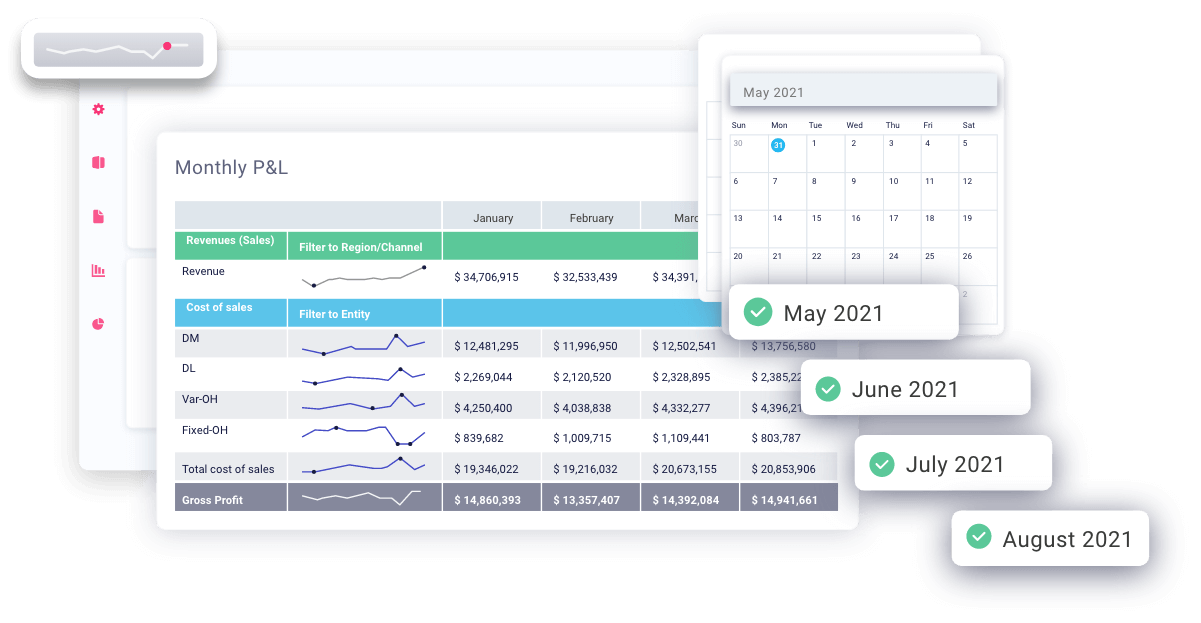

Filter your data as you see fit

Filter through your data to generate reports that meet your specific needs. All your data is consolidated in one place, just select what you want to see.

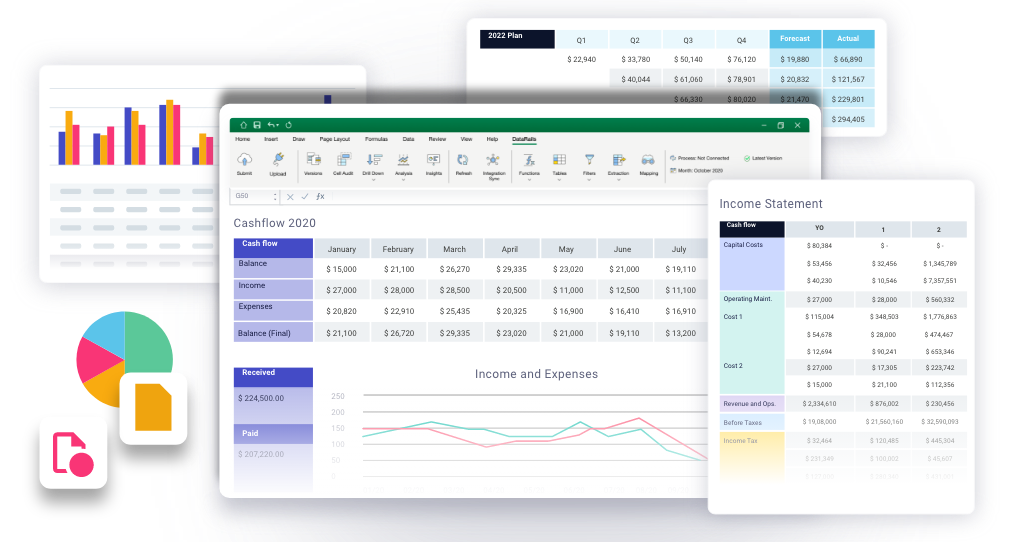

One-stop-shop for financial reporting

Centralize all your financial statements in one place, including those from different functions.

Find all of your consolidated financials, including all of the various versions and time periods, in an orderly fashion, and in one place.

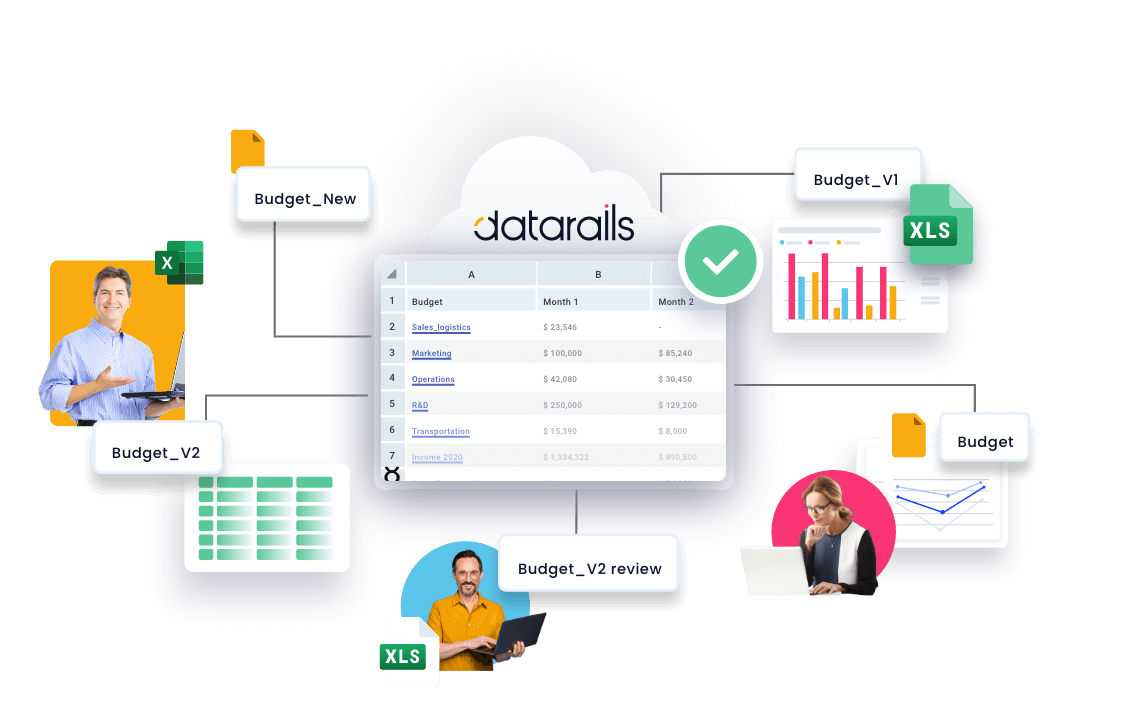

Be confident about using the right version

With Datarails’ version control software, you can be certain you are using the correct version of your files. Our centralized work environment keeps everyone on the same page.

“Datarails is saving us a lot of time and frustration and allows us to dynamically look at our business and strengths.”Lynn Hopper

Frequently Asked Questions

Financial reporting refers to the use of financial statements (income statement, balance sheet and statement of cash flows) to disclose financial data that is reflective of an organization’s financial health for a particular period of time. This information is used by management to make decisions for the company, as well as provide different stakeholders (internal and external) with information about the profitability and stability of the organization.

There are three main financial statements- the balance sheet, income statement, and cash flow statement. The balance sheet is a summary of all business assets and liabilities and shows what a company owns and what it owes. The income statement is a summary of all business income and expenses and reflects how much money a company has made or spent over a period of time. And finally, the cash flow statement reflects incoming and outgoing cash flows of an organization.

Financial accounting refers to keeping tabs on an organization’s financial transactions. These transactions are presented in financial statements such as the balance sheet or income statement. Financial reporting is broader than just the financial statements. It also includes reports that are meant to be distributed outside of the organization, such as quarterly and annual reports, and reports for governmental agencies including the SEC.

Financial reporting must be conducted in accordance with generally accepted accounting guidelines (GAAP) in the US, while in most international markets they must be in accordance with the International Financial Reporting Standards (IFRS).

As per GAAP, companies must provide reports on their cash flows, profit-making operations, and overall financial conditions. GAAP requires submitting the three major financial statements- the income statement, balance sheet, and cash flow statement.