Are you considering the FP&A career path? If so, you’ve picked wisely. The industry has many opportunities to practice what you learned in post-secondary education and learn new ways to provide value to a company. And there are plenty of opportunities for advancement.

This article will review the average education, experience, and salary you can expect at each of the four common FP&A career levels.

Before we dive into these details, let’s quickly review what a typical FPA career would entail.

FP&A Overview

FP&A teams are responsible for primary activities that support an organization’s major business decisions and financial health.

While each corporate structure and responsibility will differ slightly, the fundamental responsibilities include financial planning, budgeting, and performance and management reporting.

Planning, Forecasting, and Budgeting

Given current and historical information, the FP&A team is responsible for financial modeling, including forecasting revenue, expenses, profit, and cash flow.

They will also consider anticipated business decisions and broader industry and economic trends when building financial models.

As no organization is perfect at forecasting or predicting macroeconomic events, the FP&A team is also responsible for developing scenario models based on expected, best, and worst-case scenarios with a high-level basis for each scenario.

With this information in hand, the FP&A team and senior leadership, including the corporate development team, can plan their response.

Performance and Management Reporting

Providing ongoing performance reporting is a top responsibility of an FP&A team. Standard reporting generally follows a regular cadence, such as monthly, quarterly, and annually.

This reporting generally aligns with regulatory reporting obligations and/or scheduled corporate leadership meetings.

Ad hoc analysis and reporting are typical responsibilities of an FP&A team. They are the go-to group for analysis, forecasting, and modeling at enterprise and business unit levels.

They are considered in-house experts in both historical financial performance and forecasting future performance using common and ever-changing variables.

What are the Common FP&A Roles and Profiles?

Now that we have outlined the general role and function of the FP&A team, let’s discuss the typical FP&A roles and important information that you’re likely most interested in—the FP&A salary range, typical profile, and time spent at each level.

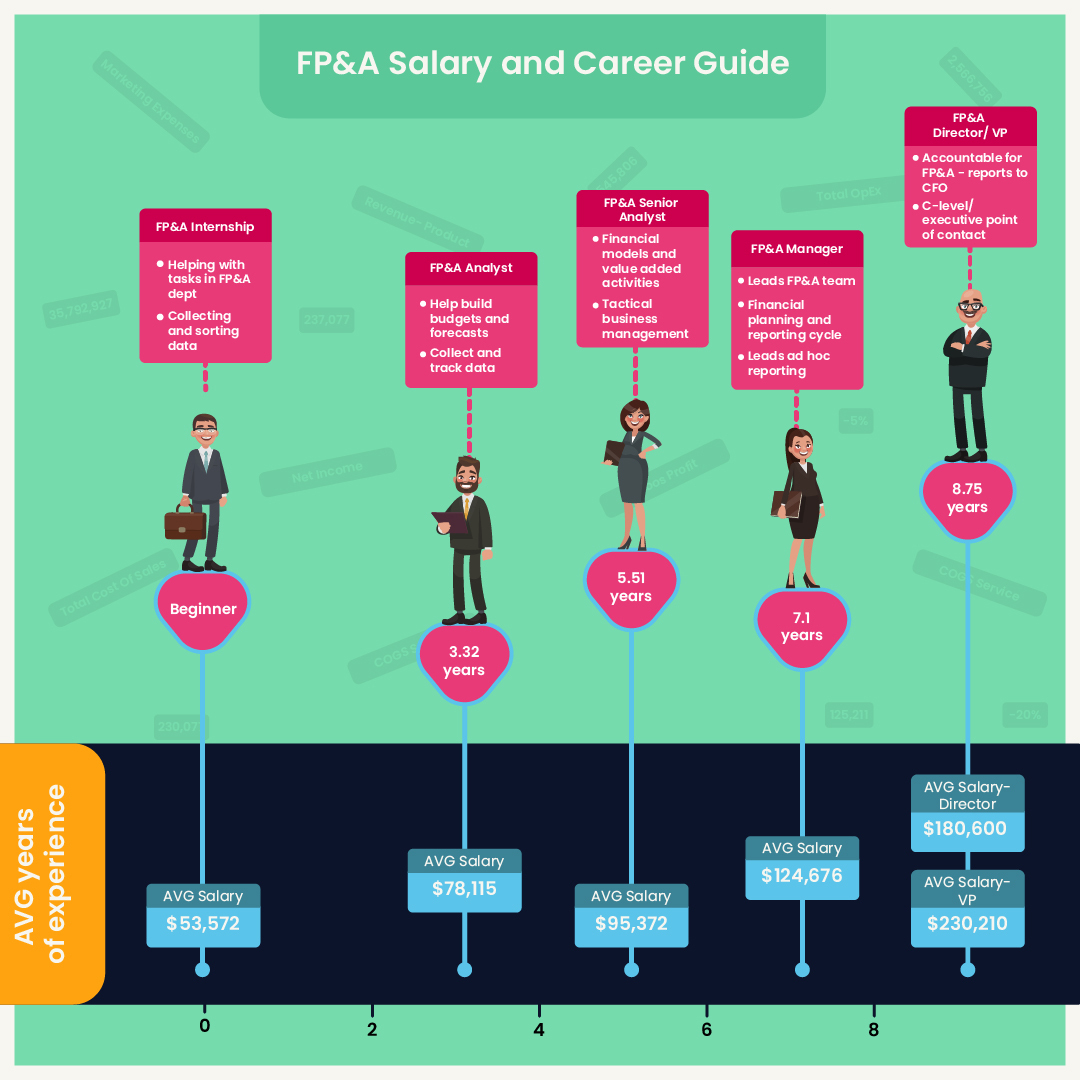

In general there are 5 levels of FP&A jobs:

- FP&A Internships

- FP&A Analyst

- FP&A Senior Analyst

- FP&A Manager

- Director of FP&A/ VP

FP&A Salaries

1) FP&A Internships

A financial analyst internship is a great starting place if you’re in post-secondary or a new grad considering a career move into FP&A. You’ll get an idea of what a career as an FP&A analyst will be like.

When you’re ready, you’ll have connections and experience to land a permanent job.

However, make sure when you’re looking and applying for an FP&A internship that it’s a financial analyst role within an FP&A team. Financial analyst is a broad term that may come with varying duties depending on the company and industry.

Students who did internships at companies, including American Express and Expedia, talked to the top FP&A podcast — FP&A Today — about the value of internships and how they secured them, including through the “LinkedIn for college students” app called Handshake.

FP&A Internship Salary and Salary Range

There is a misconception that internships are unpaid. While there are unpaid internships, the average financial analyst internship hourly wage is between $30 and $36, according to information from Salary.com.

Time Spent as an FP&A Intern

The average duration of an internship is typically four months but can be as long as 12 months.

2) FP&A Analyst

An FP&A analyst is typically a role for junior analysts or intermediate analysts. However, FP&A analysts will often have one to three years of professional experience before their FP&A analyst role.

Responsibilities may include:

- Creating or updating financial planning models, often using Excel.

- Lead the collection and consolidation of data.

- Track and forecast revenue, expenses, profit, and cash flow by business unit or group.

- Liaise with senior leadership across business units.

- Help build monthly, quarterly, and annual budgets and forecasts for different business units and consolidate them into an enterprise-level budget.

- Analyze financial performance and compare performance against known competitors.

- Prepare variance analysis to explain why actual results differed from the plan and forecast.

FP&A Analyst Salary and Salary Range

According to ZipRecruiter data, the average FP&A analyst salary in the US is $91,143 annually, ranging between $145,500 and $45,500.

Time spent as an FP&A analyst

Most FP&A analysts spend one to three years on the job before being promoted.

3) FP&A Senior Analyst

Before graduating to the senior analyst level, these analysts will typically have experience as FP&A analysts and other finance or accounting experience.

This senior FP&A role moves from data collection, compilation, and inputting into financial models into a more value-added role.

This role is the first level of the FP&A team that really starts to think about what the information is saying and what decisions this may lead to.

While an FP&A analyst may calculate certain metrics or KPIs, an FP&A senior analyst will know and be able to communicate the information’s meaningfulness.

Responsibilities may include:

- Help guide junior FP&A analysts and review financial models for accuracy and completeness.

- Complete sensitivity analysis on the impact of revenue, cost, and profits, considering macroeconomic variables such as the US Fed Rate increase.

- Build a scenario analysis given the strategic and tactical business decisions being evaluated.

- Budget, actual, and forecast variance analysis and explanations.

- Ad hoc management reports as required.

FP&A Senior Analyst Salary and Salary Range

The average FP&A senior analyst salary in the US is $96,423, ranging between $121,000 to as low as $55,000, depending on the location and company size.

Time Spent as an FP&A Senior Analyst

The average years of experience for an FP&A senior analyst ranges from three to five years, plus an MBA.

4) FP&A Manager

The FP&A manager typically leads an FP&A team comprising FP&A analysts and senior analysts, who may also include interns. They are instrumental members of the financial planning and reporting team.

FP&A managers typically have years of experience performing the duties and responsibilities of both analyst and senior analyst positions.

They are the main point of contact with the leaders of each business unit and will assist their FP&A analysts if they face hurdles in their roles.

Responsibilities may include:

- Providing leadership to the FP&A team.

- Responsible for the financial planning and reporting cycle, including budgets and forecasts.

- Creates a positive working relationship with other groups.

- Guide business unit senior leaders on their performance and recommend corrective actions.

- Lead the development of ad hoc reporting.

- Accountable for the overall performance of the FP&A team.

FP&A Manager Salary and Salary Range

The average FP&A manager salary in the US is $109,585, ranging from $58,000 to $156,500.

Time Spent as an FP&A Manager

According to Mergers and Inquisition’s estimate, the average years of experience for an FP&A manager are between six and ten years.

5) FP&A Director or VP

The FP&A director or VP often reports to the Chief Financial Officer (CFO) and is ultimately accountable for FP&A in the company and leads the FP&A team.

They are the main C-level or executive point of contact regarding FP&A and are one of the senior accounting and finance roles that would lead to becoming a CFO.

FP&A Director or VP Salary and Salary Range

- According to Glassdoor data, the average FP&A director salary in the US is $149,983, ranging from $101,500 to $200,500.

- The average FP&A VP salary in the US is $169,537, ranging from $64,500 to 260,000.

Time Spent as an FP&A Director

- According to Mergers and Inquisitions, reaching this level usually takes 10+ years. But as you’ll see in 2024 Salary/Compensation, a popular Reddit thread, it can happen sooner.

Is FP&A a Good Career?

Financial planning and analysis is an appealing career choice to many thanks to a combination of rewarding strategic work, analysis, and the opportunity to earn a high income.

FP&A team members are critical to an organization, ultimately ensuring its financial health. Historically, FP&A professionals have been at the forefront of some of the most impactful business decisions.

FP&A is in high demand among finance roles. As businesses become more data-driven and analytical, FP&A teams become increasingly critical to the organization’s success.

Because of the breadth of the work involved, FP&A professionals can also follow various potential career paths.

FP&A is worth considering for someone who relishes a challenge, a constantly stimulating environment, and the opportunity to learn new things.

How to Get Into FP&A

While there is no one-size-fits-all formula, most paths to an FP&A career begin with a combination of education, experience, and skills.

Education is often the starting point – an FP&A professional typically has a solid education in finance, accounting, economics, or a related field.

While a bachelor’s degree is typically the minimum requirement for most FP&A positions, additional education is a considerable advantage. For senior FP&A roles, it might even be necessary.

Many FP&A jobs, especially senior positions, require an MBA or other advanced degrees and certifications, such as CPA.

Relevant work experience is also crucial. FP&A analysts typically start their careers as financial analysts, accountants, or auditors.

Second, improve your proficiency in financial software and tools. FP&A analysts spend significant time building financial models using Microsoft Excel, Google Sheets, and similar tools, so proficiency is important.

Networking and mentorship are also important.

Talking to people who are already in FP&A helps you understand the industry and learn about job opportunities.

Attending finance-related professional organizations, industry conferences, and online communities can help you meet new contacts who might help you advance your career.

Experience in financial modeling, strategic planning, and scenario analysis will also be especially useful for those moving from another finance role to demonstrate their readiness for an FP&A role.

Frequently Asked Questions (FAQs)

Is FP&A a good career start?

Yes. However, most FP&A analysts don’t start their careers in FP&A. They typically start in an accounting or finance role. With one to three years of experience, accounting and finance professionals often seek out FP&A roles.

What is the highest salary in FP&A?

The highest average base salary and total compensation in an FP&A team will typically be the director or VP.

As shown earlier in the article, directors and VPs can earn an average base salary as high as $210,300 and $268,850, respectively.

Add on bonuses, stock options, and other benefits, and it’s easy to see a career in FP&A can be highly lucrative.

Is FP&A tough?

Yes, FP&A can be a tough and stressful job.

During busy times, there can be long days and weekend work, and ad-hoc reports from senior leaders often need to be completed as soon as possible.

FP&A senior management will typically have the most demanding and most stressful position on the team.

However, each member of the FP&A team is well compensated, which can make those stressful periods easier to manage.

While FP&A roles can be stressful sometimes, they aren’t considered as demanding or stressful as notoriously stressful careers such as investment banking.

Does FP&A pay better than accounting?

FP&A typically pays better than technical accounting jobs. However, a large percentage of FP&A analysts are, in fact, CPAs and have some experience in accounting as well.

Is FP&A well paid?

Yes, FP&A jobs are considered well-paying, with a high average base salary. Other notable benefits include the opportunity to work on exciting projects and the prospect of career advancement.

FP&A roles will also often lead to corporate development or corporate finance roles.

Do you need CFA for FP&A?

No, you don’t need to be a Chartered Financial Analyst (CFA) to get a job on an FP&A team.

However, a CFA is the most prestigious credential for financial professionals. It strengthens your background in finance fundamentals and makes you more competitive when applying for FP&A roles.

It will also give you more opportunities to explore career options in fields such as investment banking and business development.

Does FP&A lead to CFO?

Absolutely. Many CFOs are CPAs or CFAs who have spent part of their career in FP&A roles.

Plenty of CFOs—many of whom come from large companies such as Papa John’s and Hubspot—started in FP&A and rose to CFO.

In fact, according to Deloitte, 47% of CFOs had some experience in FP&A before becoming CFOs.

Should I get a CPA for FP&A?

Getting a CPA or having an accounting background helps give you knowledge of the fundamentals of accounting that will benefit you in an FP&A role.

In a study carried out on 500 top FP&A positions, including companies such as Netflix, Apple, and Tesla, 15% mentioned a CPA as preferable.

For instance, a senior finance analyst FP&A role at Johnson & Johnson says: “MBA, financial certification in ACA, ACCA, CIMA, CPA, CMA or other equivalent is preferred.”

While you don’t need to have a CPA for an FP&A role, it will make you more competitive when applying compared to applicants who may not have one.

In addition, many courses provide FP&A certification, which can help improve your finance skills and give you an advantage over the competition.

Do I need an MBA for FP&A?

Also useful to land a top FP&A role, 34% of top job listings ask for an MBA. Kedar Kale, MENA FP&A at Amazon, says:

“The strength an MBA brings to an FP&A role is in terms of better business acumen, presentation skills, and the ability to connect the dots.

However, an MBA who has not studied finance or accounting courses, whether pre-MBA or as a part of the MBA, would find it difficult to develop comfort with the heavy financial data, at least initially.”

Did you learn a lot about the FP&A career path in this article?

Here are three more to read next: